Decoding the 2024-2025 Union Budget

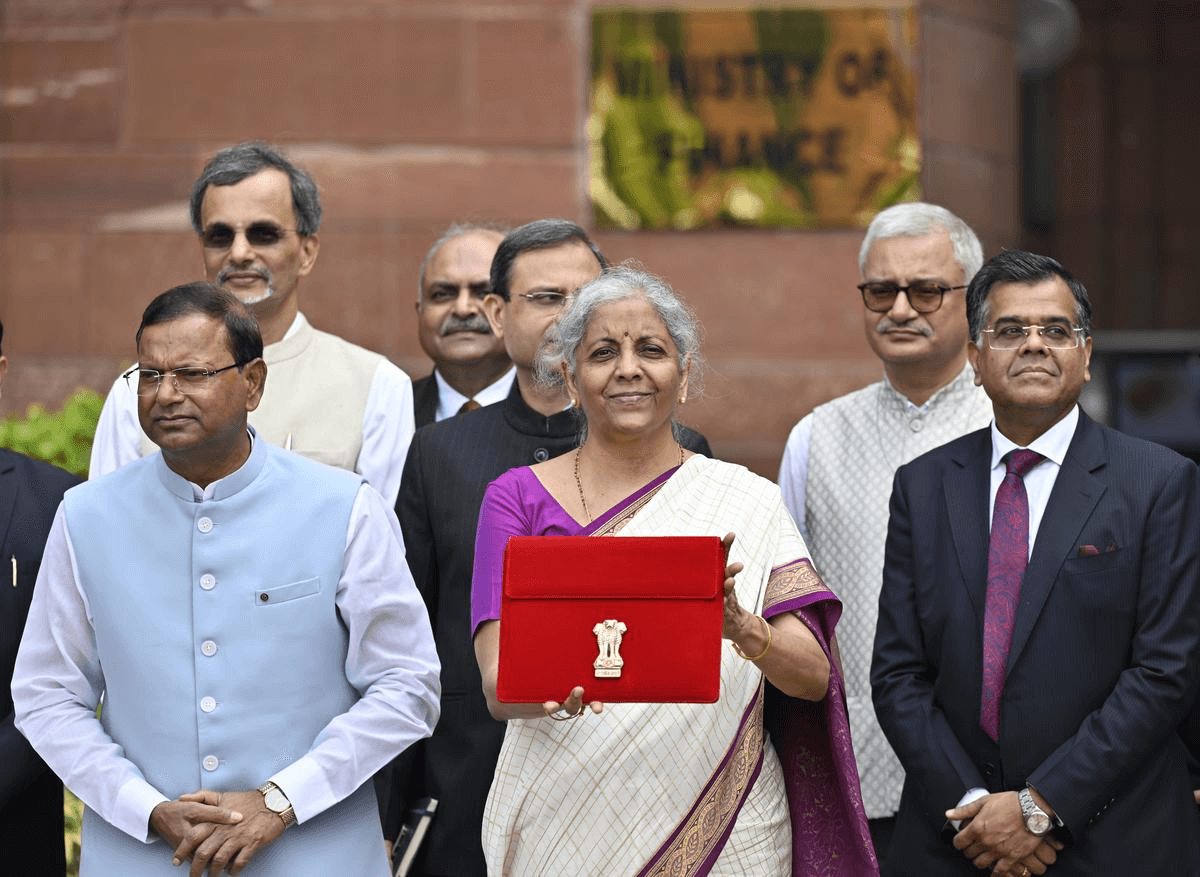

The inaugural budget of the BJP-led NDA government’s third term revealed a flurry of measures aimed at fixing the woes of unemployed youth, small businesses, and the middle class, and sought to strengthen the ruling NDA coalition’s bonds with support for multiple investment projects in Bihar and Andhra Pradesh. The overarching theme of the 2024-25 Union Budget was EMPLOYMENT. Used as an acronym the theme spelled out as Employment and Education; Micro, Small and Medium Enterprises (MSMEs); Productivity; Land; Opportunities; Youth; Middle Class; Energy Security; New Generation Reforms; and Technology. The Finance Minister termed the budget as a step towards the goal of Viksit Bharat and Amrit Kaal. Conversely, the opposition remarked that the budget is discriminatory and ignores the interest of the middle class, farmers and rural poor.

Government Juggles Fiscal Deficit and Growth While Inflation Looms Large

The fiscal deficit which is estimated at 4.9% of GDP in the Union Budget 2024-25 has reaffirmed the government’s priority of macroeconomic stability. With a prudent use of the surplus dividend of 0.4% of GDP given by RBI in April 2024 the fiscal deficit target has been brought down by 0.7% of GDP as compared to 5.6% of the previous year (2023-24). The Government of India could have reduced the deficit more, but doing so too quickly might create a situation where economic growth would slow down. Instead, the remaining RBI dividend was allocated to fund interest-free loans for state capital expenditures. The capital expenditure for FY25 in the budget was Rs. 11.11 lakh crore, that is 3.4% of the GDP. Even though the quality of government expenditure in the budget has improved, increasing the share of capital expenditure in total expense to 23% in 2024-25, the jump in capex target for this fiscal year sharply lags that of the 37% spike for the previous fiscal year. The budget has failed to address the higher consumer price inflation issue effectively which currently stands at 5.08% (provisional) as of June 2024. Although it aims to ensure that inflation moves towards the 4% target.

Better Tax Thresholds, Yet Hidden Costs

Tax slabs were revised in the budget with the introduction of the new tax regime. The revised income threshold for individuals in the 5% tax bracket has been raised from six lakh to seven lakh. For those in the 10% tax bracket, the limit has increased from nine lakh to ten lakh, while the 15%, 20%, and 30% tax brackets remain the same. Although there is a transition from the old tax regime to the new one, these adjustments in tax slabs will likely make the new system more appealing and practical for the higher middle class, even if only marginally. Selecting the new tax system does, however, come with some disadvantages. If you choose to go with it, you forfeit many deductions that were available under the previous system, including the House Rent Allowance (HRA), travel expenses, Section 80D medical insurance premiums, and others. On one hand where the deduction for the salaried individual has been increased by Rs.25,000 the government from Rs. 50,000 to Rs. 75,000 and the deduction on family pension for pensioners was enhanced from Rs. 15,000 to Rs. 25,000, Short Term Capital Tax Gains (STCG) on certain investments were revised from 15% to 20% resulting in a 5% hike. This means that though the government provided direct benefit through standard deduction to individuals it indirectly put more burden on their pockets as individuals who sell their investments within a short period will have to pay a higher tax on their profits.

Employment Surge in Budget Overshadowed by Cuts in Defence and Education

The 2024-25 Union Budget reflected the government’s new found focus towards employment, with the Finance Minister, Nirmala Sitharaman using the word ‘employment’ 23 times in this budget as compared to three times in the budget of 2023-24. Amidst the increased focus on employment with announcement of the Prime Minister’s package for employment and skilling with a massive central outlay of Rs. 2 lakh crore, the Ministry wise allocation saw fluctuations.

With rising geopolitical threat and global insecurity the defence expenditure as a share of the total budget expenditure was reduced to 9.43%, lowest in the past nine years, conversely the neighbouring countries of India like China and Pakistan have increased their defence budget by 7.2% and 17.6% respectively. The government is prioritising the development of a skilled and employable youth by introducing financial support for higher education loans up to Rs 10 lakh for domestic institutions. However, this focus is contrasted by a significant reduction in education expenditure, with the grant for the higher education regulator, UGC, being cut by over 60%. This reduction could potentially undermine the government's objective of cultivating a highly educated workforce capable of fulfilling employment opportunities, raising concerns about the overall effectiveness of their strategy in achieving these goals. A substantial increase was also seen in the budgetary allocation for PM-Ayushman Bharat Health Infrastructure Mission, Pradhan Mantri Jan Arogya Yojana. Although there has been a double-digit increase in healthcare funding, that country has failed to meet the National Health Policy 2017's target of allocating at least 2.5% of GDP to healthcare.

Conclusion

The 2024-25 Union Budget shows a mix of change and consistency in the government's economic plan through its range of reforms and targeted packages. It lays out a medium-term vision by highlighting nine main priorities. These cover farming, industry and services, infrastructure, jobs and skill growth, upcoming reforms, new ideas and scientific research, city growth, social sector changes, and energy security. For the first time, the government has recognized current economic problems showing a deeper grasp of the nation's financial situation, yet big gaps still exist. The lack of a clear plan to sell state-owned companies stands out since public sector firms have high stock market values. This reflects a missed chance that could have brought in private money and made the economy work better. Also, the budget didn't give a strong push to boost product exports, missing an opportunity to tap into foreign demand when local spending is slow. Tackling these issues could make the budget's effects stronger and help create a more lively economic scene.

Kanika Sharma / New Delhi