RBI rings Alarm Bells: Rising State Government Debt, Declining Revenues

The original version of the article was published on 27th July 2022 in “The Daily Guardian”

The economic crisis in Sri Lanka, which has led to complete political and social collapse in the country has served as an alarming reminder of unsustainable public debt and its impact on the economy of a country. A recent article published by the Reserve Bank of India (RBI), written by a team of economists including Atri Mukherjee, Samir Ranjan Behera, Somnath Sharma, Bichitrananda Seth, Rahul Agarwal, Rachit Solanki, and Aayushi Khandelwal, under the guidance of Deputy Governor Michael Debabrata Patra, highlights that fiscal conditions in many states in India are showing warning signs of building stress. The article brings into focus the debt of many Indian states and the lack of sustainability in public finances. The main factors that affect this sustainability include a slowdown in tax revenue collection, higher expenditure, and an increased subsidy burden.

Perhaps what is more worrisome is that for some states, the debt growth has now outpaced the growth in Gross State Domestic Product (GSDP), which when combined with increasing risks, puts the economy of these states in a precarious position. Overall, the fiscal position of many states, which had already been struggling to recover from the financial impact of the COVID-19 pandemic, has heavily deteriorated in the past year, due to a sharp decline in revenue, an increase in spending, and a sharp rise in debt to GSDP ratios.

WHAT ARE THE KEY FINDINGS OF THE ARTICLE?

States including Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, Uttar Pradesh, and Haryana were recorded as having the highest debt burden and account for half of the total expenditure by all the state governments in India. For these ten states, the ratio of their Gross Fiscal Deficit to GSDP is also equal to or more than 3.0 per cent in 2021–22, with Punjab being at the top at 9.60 per cent, followed by Andhra Pradesh at 6.1 per cent, West Bengal at 6.0 per cent, Haryana at 5.3 per cent, and Kerala at 5.1 per cent.

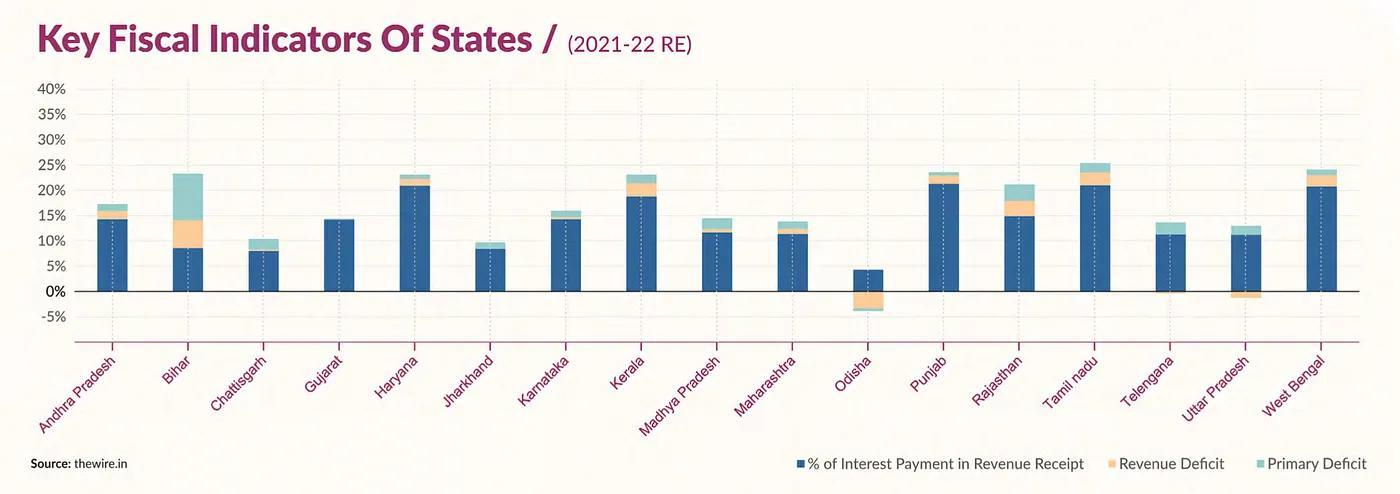

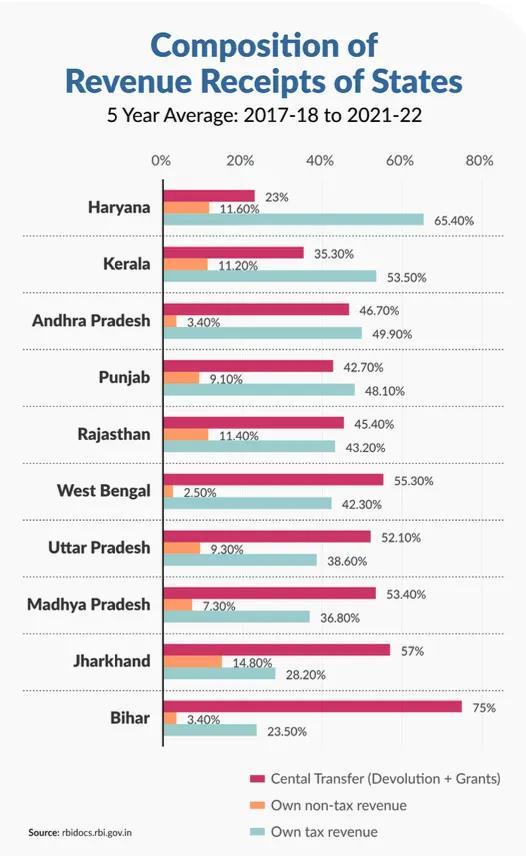

Additionally, eight out of these ten states also have an interest payments to revenue receipts ratio of more than 10 per cent and have been recording a decline in State’s Own Tax Revenue (SOTR), particularly Madhya Pradesh, Kerala, and Punjab. Ideally, the real rate of interest on debt should be lower than the real GDP growth rate. However, in the five states with the most debt, the rate of growth of public debt has turned out to be higher than GSDP growth most of the time in the last five years. The article warns that for the five most indebted states — Bihar, Kerala, Punjab, Rajasthan, and West Bengal — the debt stock is no longer sustainable, as the debt growth has outpaced their Gross State Domestic Product (GSDP) growth in the last five years.

The increased level of debt also implies that a state spends a significant share of its revenues on servicing the debt. Several states spend about 10 per cent or more of revenue receipts on interest payments, with Punjab and West Bengal spending more than 20 per cent.

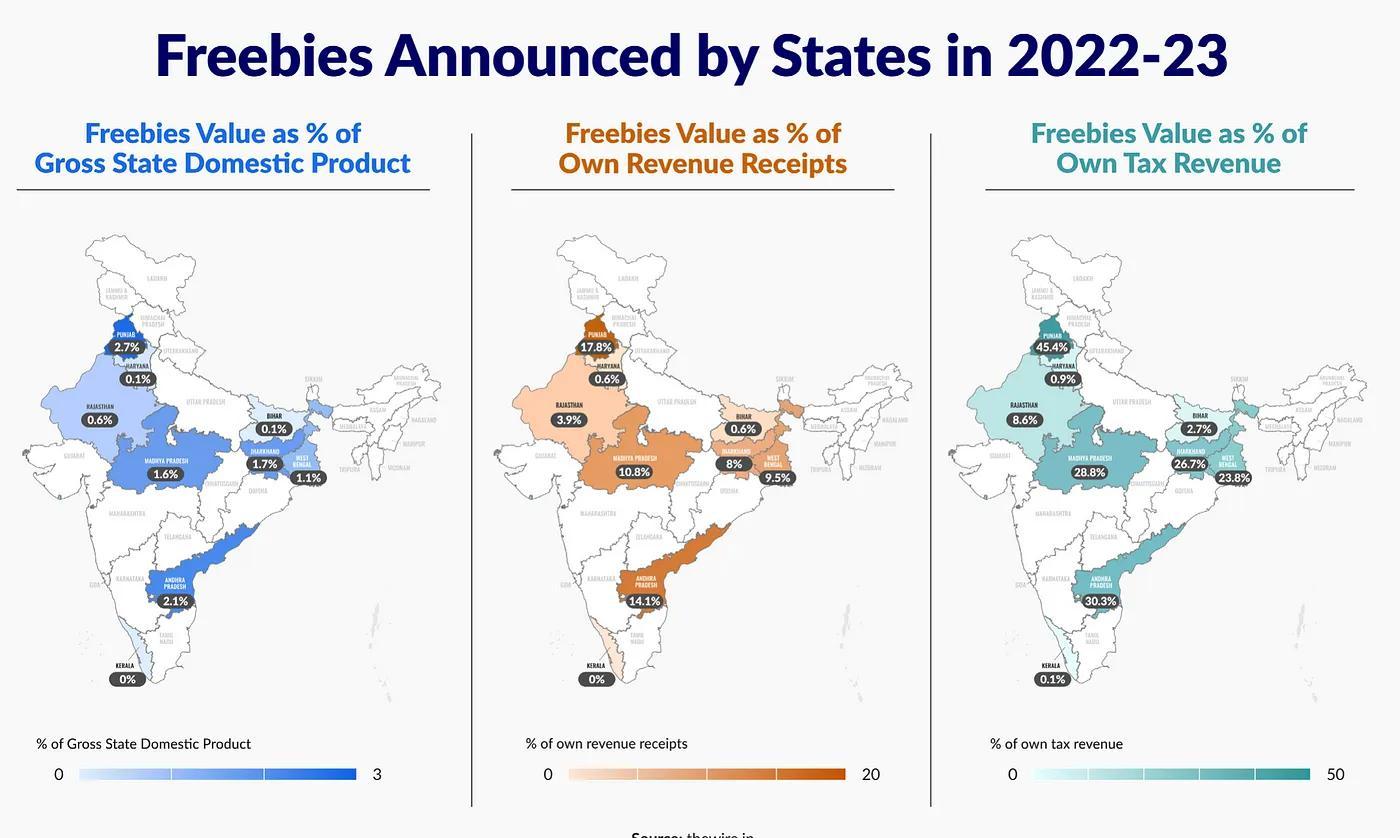

Another key finding in the article is that the share of subsidies in total revenue expenditure has increased from 7.8 per cent to 8.2 per cent during 2019–20 and 2021–22 for 19 states. In fact, states like Punjab, Rajasthan, and Chhattisgarh spend more than 10 per cent of their total revenue expenditure on freebies. The poor financial situation of the state governments can also be attributed to declining tax and non-tax revenues, which affects their expenditure planning and increases their dependence on market borrowing. The tax revenue of various states, including Madhya Pradesh, Punjab, and Kerala, has been declining over time, making them fiscally more vulnerable.

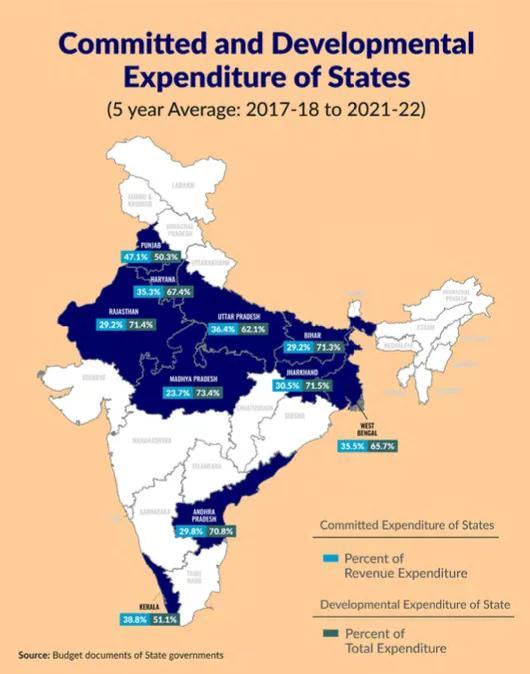

Any further shocks or pressures, including the relaunch of the old person scheme by some states, rising expenditure on non-merit freebies, expanding contingent liabilities, and the ballooning of distribution companies, is likely to significantly increase stress risks in the fiscal conditions of many states, jeopardising the fiscal sustainability of these states. The report goes on to highlight that as per stress tests, the conditions of the most indebted state governments will continue to deteriorate further, with their debt-GSDP ratio likely to remain above 35 per cent in 2026–27.

ARE FREEBIES AND SUBSIDIES TO BLAME?

Referring to the economic collapse in Sri Lanka, the article states that this was not only fueled by the pandemic, but also by the policy decisions of the government, particularly the provision of subsidies. The report raises similar concerns for several Indian states. As per the data of the Comptroller and Auditor General (CAG), the monitoring financial authority of central and state governments, the expenditure on subsidies by state governments had increased by 12.9 per cent during 2020–21, 11.2 per cent during 2021–22, while it had briefly contracted during 2019–20. The highest increase in the provision of subsidies was recorded in Jharkhand, Kerala, Odisha, Telangana, and Uttar Pradesh. Andhra Pradesh, Madhya Pradesh, and Punjab, for instance, incur a very high subsidy bill by doling out freebies that go over and above 10 per cent of their total revenue receipts. For states like Andhra Pradesh and Punjab, already battling with heavy indebtedness, freebies are a concern as their dole out is steadily inching up to more than 2 per cent of the GSDP.

The main areas in which subsidies were provided include education, rural development, social welfare (pension schemes), and energy (power subsidies). While some subsidies such as employment guarantee schemes, education, and health-care bring economic development along with being public goods, others such as loan waivers, electricity and water concessions could cause long-term economic stress on finances. This distinction between subsidies is critical for states to consider when evaluating the fiscal and long-term impact of providing them. While some freebies can benefit those economically disadvantaged, it is important to highlight their large fiscal costs and the inefficiencies in their provisions, which not only distort market prices but also cause the misallocation of resources.

The report mentions that the government of Sri Lanka had a huge deficit — it used to spend a lot more than it made in revenues and was already in debt to several international lenders and banks. In addition to this, the economic inefficiencies in the provision of subsidies contributed to rising inflationary pressures on the country, leading to a situation where ordinary citizens could not even afford basic necessities. In the recent past, political parties have resorted to using freebies as election promises in order to lure voters. The provision of continuous freebies without proper economic management will not only increase the fiscal debt of states but also generate long-term inflationary pressures on the economy. While freebies do not directly lead to enormous debt, their poor economic management does, and this has been seen in the cases of states such as Jharkhand and the Union Territory of Delhi, both of which recorded a budget surplus.

The report serves as a reminder to state governments to evaluate their fiscal debt burden and find avenues to improve the pressures on their economy. The focus of states needs to be on stabilising debt levels and restricting revenue expenses by cutting down the expenditure on non-merit subsidies (subsidies apart from those provided for merit goods such as food, education, and health). Other recommendations by the report include large-scale reforms in the power distribution sector, which would make discoms (power distribution companies) financially sustainable and operationally efficient and conduct regular fiscal risk analyses.

Shreya Maskara/New Delhi

Contributing reports by Aparna Girli Babu, Ratika Khanna and Arin Prabhat, Researchers at Polstrat.

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.

Read more about Polstrat here. Follow us on Medium to keep up to date with Indian politics.