Repo Rate takes a Hike

The original version of the article was published on 15th June 2022 in “The Daily Guardian”

On 8 June 2022, the Reserve Bank of India (RBI)’s Monetary Policy Committee (MPC) increased the policy repo rate under the liquidity adjustment facility (LAF) to 4.90 per cent, a hike of 50 basis points from the previous revision in May 2022. The move follows a sudden off-cycle revision in the repo rate in the month of May when the MPC increased the repo rate by 40 basis points to 4.40 per cent. Both moves aimed at curbing the heightened inflation levels caused by various domestic and international factors, including but not limited to the Russia-Ukraine conflict and the COVID-19 pandemic.

The 08th June revision is the second consecutive hike in the benchmark repo rate after a year-long consistency by the RBI in an attempt to boost economic growth. The MPC at its meetings in April, June, August, October, and December of 2021 had kept the policy repo rate consistent at 4 per cent for the Financial Year 2021–22. RBI, in its Monetary Policy Statement of 08th June, emphasised that the current hike was ‘in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth’.

Monetary Policy and Downward Economic Trends

The RBI uses the benchmark repo rate as one of the main tools to regulate the monetary situation in the Indian economy. Repo rate is the rate at which the central bank of a country lends money to commercial banks in the event of any shortfall of funds. A hike in repo rate increases the cost of borrowing in the economy for domestic consumers and businesses. It reduces their purchasing power and investment capacity thereby helping bring down inflation. However, a lower repo rate often helps in giving a push to economic activity by promoting lending by the banks (a fall in repo rate is an incentive for banks to reduce their Rate of Interest on loans).

The past two years witnessed a slowing down of economic activity owing to COVID-19-induced curbs and a global economic downturn. The Indian economy contracted by 23.8 per cent in the starting months of the COVID-19 pandemic from April to June 2020 and 6.6 per cent in the July to September quarter of 2020. Overall, according to the National Statistical Office (NSO), GDP contraction for the financial year 2020–21 was 6.6 per cent. In the financial year of 2021–22, according to NSO’s February estimates, GDP growth stood at 20.3 per cent in the April to June quarter and 8.5 per cent in the July to September period.

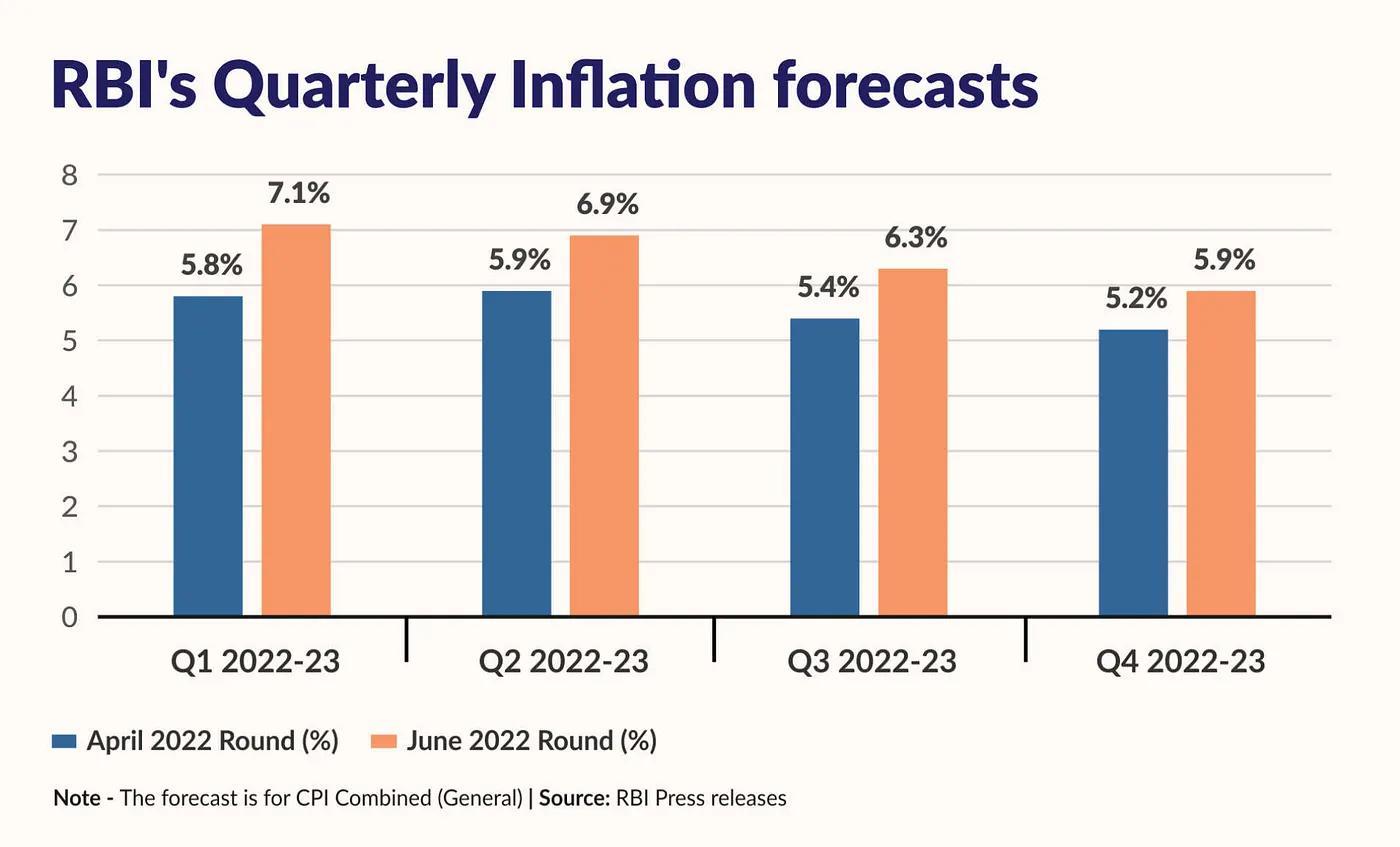

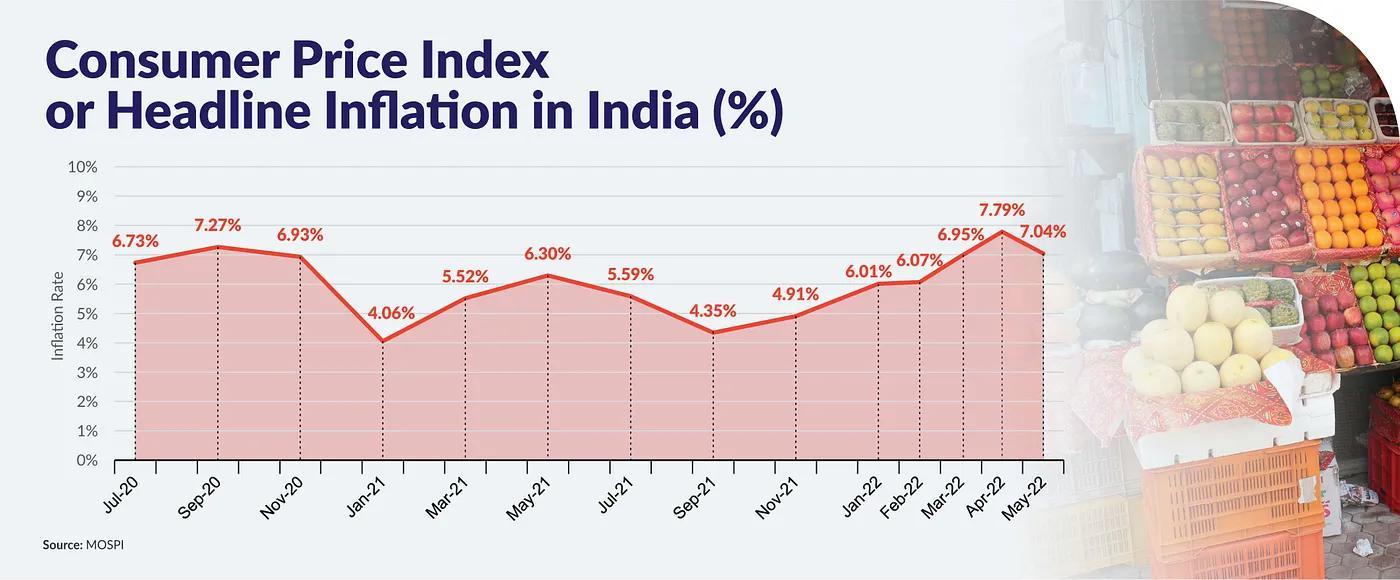

During this period, the RBI focused on promoting economic activity and lending in the economy through its monetary policy. To stave off the reduced economic activity, the MPC dropped its repo rate by 75 basis points in a month from 5.15 per cent in February 2020 to 4.40 per cent in March 2020. After reducing it further by 40 basis points, the repo rate remained consistent at 4 per cent for nearly two years from May 2020 to May 2022. According to the Ministry of Statistics and Programme Implementation (MOSPI) numbers, Consumer Price Index (CPI) general or headline inflation in India fell from a high of 6.73 per cent in July 2020 to to 4.06 per cent in January 2021 before rising back to 7.79 per cent in April 2022 (nearly an eight-year high). According to the most recent MOSPI figures, inflation for the month of May 2022 has eased to 7.04 per cent. However the falling inflation is unlikely to contribute much to slowing down the recent RBI rate hike cycle.

Broad-Based Price Rise

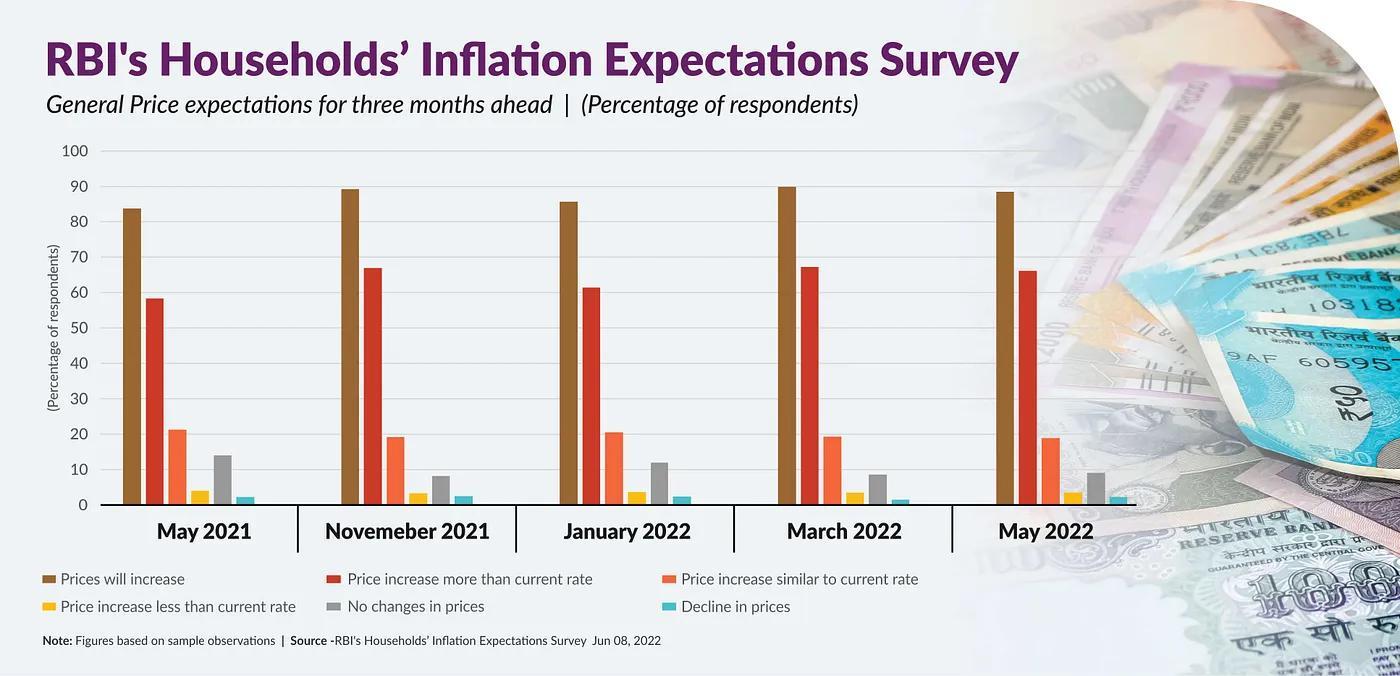

In its June report, the RBI highlighted the broad-based nature of inflation which was showing up in rising prices of services and was no longer limited to goods inflation. Notably, between February and April of 2022, the headline inflation has risen by about 170 basis points. The wholesale price inflation, a measure of price rise at the level of producers, has consistently been in double digits for 12 consecutive months between April 2021 and April 2022. In November 2021, it touched a high of 14.87 per cent driven largely by the rise in crude oil prices in the international market. On the other hand, retail inflation, which directly impacts the local consumer, has been on a constant uptick since September last year, touching 6.07 per cent in February 2022. Retail inflation witnessed a rise mainly owing to rising prices of essentials like oils and fats, vegetables, and protein-rich items such as ‘meat and fish’.

The Russia-Ukraine conflict and the COVID-19 pandemic have disrupted supply chains and led to a shortage of various goods globally, resulting in inflation and economic distress in several countries. Moreover, sanctions on Russia have impacted the supply of crude oil and pumped up prices in international markets. The rise in fuel prices has a direct impact on transportation costs thereby pushing the prices of all other commodities.

The current repo rate hike of 50 basis points aims to deal with the impact of the above developments on the Indian economy. It is coupled with the MPC’s changed stance from May 2022 onwards from a ‘commitment to remain accommodative’ to ‘withdrawal of accommodation’. It reflects the RBI’s decision to shift its focus from giving a thrust to economic growth through reduced rates to controlling the rising inflationary trends through costly lending. While the repo rate remains below the pre-pandemic level of 5.15 per cent, this recent hike is a desperate attempt to bring prices of goods and commodities down and reel in inflationary pressures.

State of Indian Economy: Projections

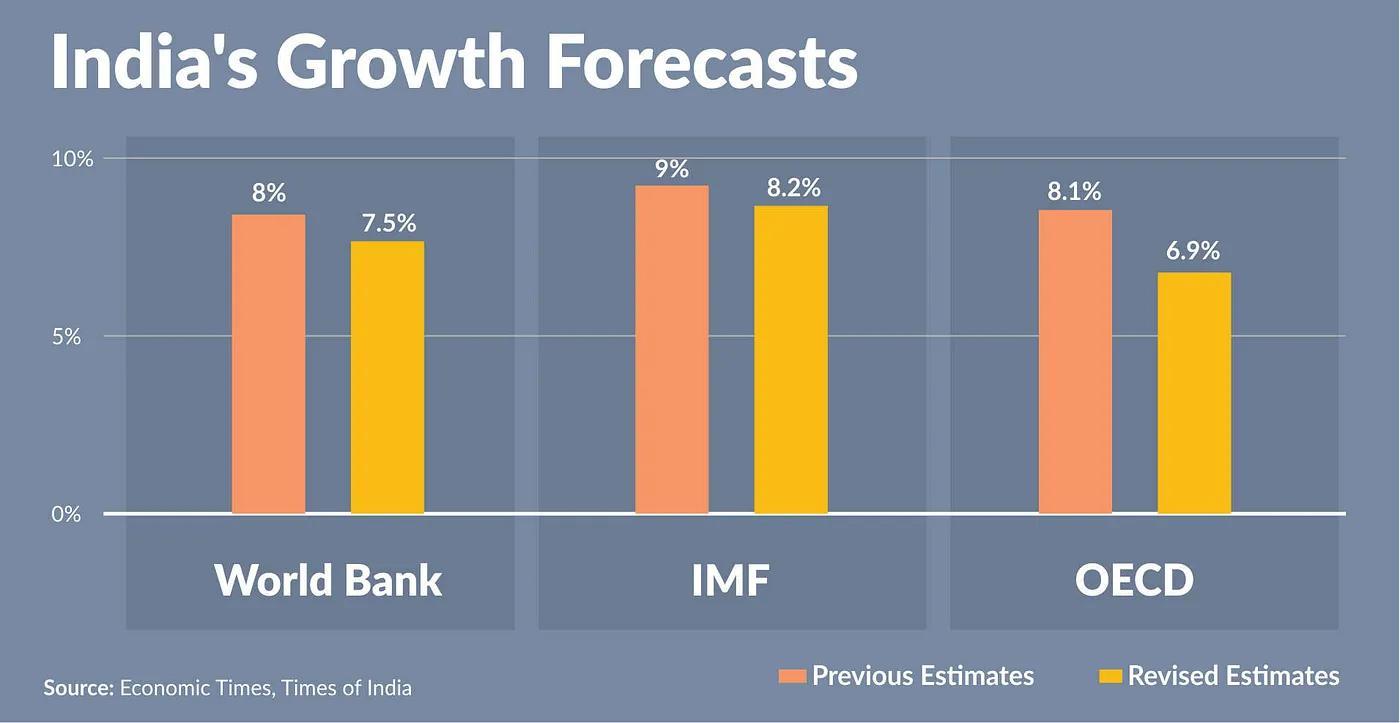

According to the MPC’s June meeting, the Indian economy is expected to broaden its recovery going forward owing to several positive developments. Contact-intensive services are likely to bolster urban consumption, investment is expected to receive a boost through improved capacity utilisation, the government’s capex push, and strengthening of bank credit and rural demand, which is gradually improving from a normal south-west monsoon. However, several international organisations have cut down their projections for India’s GDP growth for the ongoing fiscal year. The Organisation for Economic Cooperation and Development (OECD) warns that the Indian economy is losing its growth momentum because of inflationary pressures from rising global energy and food prices even as monetary policy normalises and global conditions deteriorate. It has cut down its growth forecasts for India from 8.1 per cent predicted in March to 6.9 per cent in June 2022.

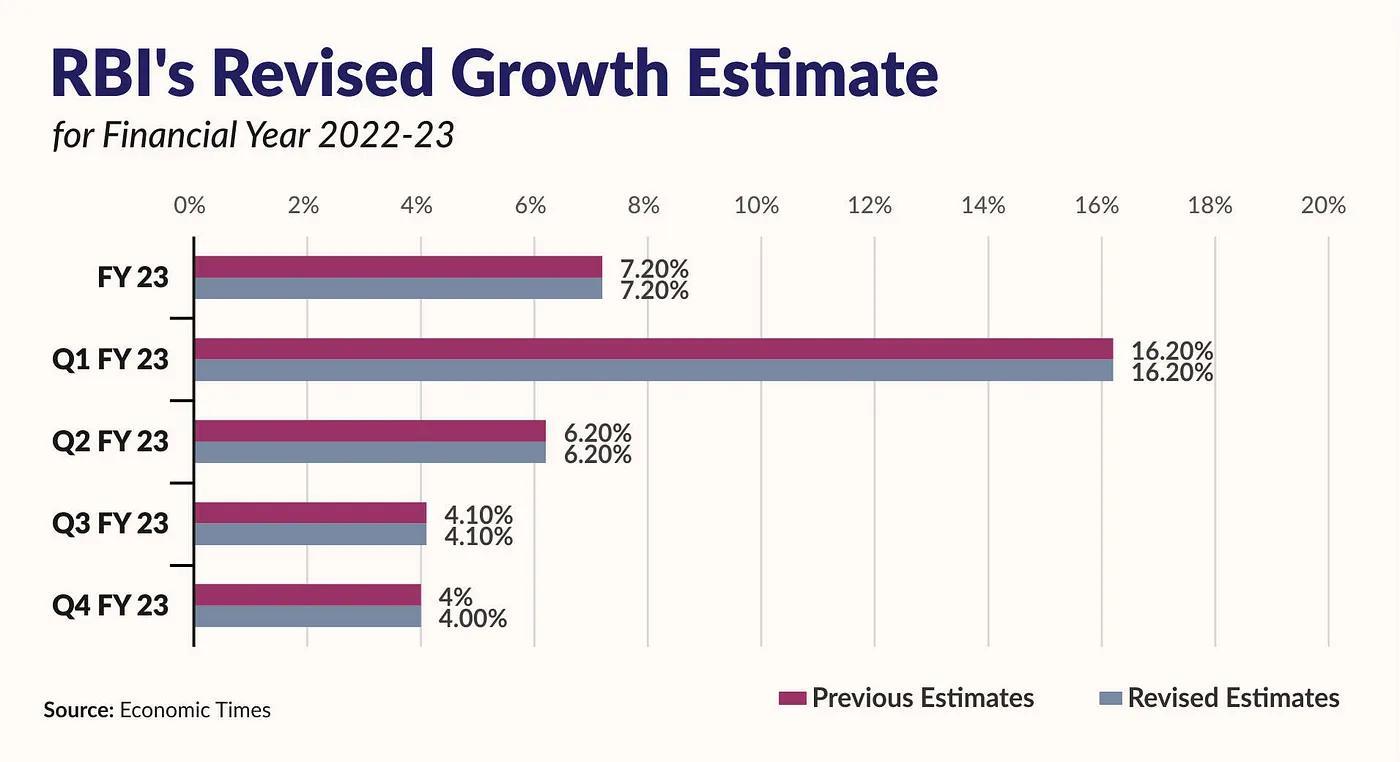

The World Bank has also cut down its GDP growth forecast for India for this fiscal thrice from the previous 8.7 per cent to 8 per cent in April and 7.5 percent in June 2022. The International Monetary Fund which, in January 2022, predicted a much higher growth rate for India this fiscal at 9 per cent has brought down its estimates too but remains positive that the country will clock a growth rate of 8.2 per cent (June estimates). The RBI’s real GDP growth projection for 2022–23 is retained at 7.2 per cent. According to the projections, the first quarter will record a growth rate of 16.2 per cent, declining significantly to 6.2 per cent, 4.1 per cent, and 4.0 per cent in quarters two, three, and four, respectively.

Persistent geopolitical tensions, sanctions on Russia, a resultant rise in crude oil prices and the lingering supply chain bottlenecks due to the COVID-19 restrictions have contributed to inflationary trends in India and abroad. Moreover, while the domestic restrictions on wheat export are expected to augment supply at home and ease off food inflation, heatwave-induced shortfall in rabi crops’ production may be a contributing factor to high food inflation in the country. The change in the RBI’s policy and a hike in repo rate is driven largely by the intent to deal with the impact of the above factors on the Indian economy and is likely to lead to a further hike in the coming fiscal year.

Damini Mehta/New Delhi

Contributing reports by Arin Prabhat, Ashita Koul, Kaustav Dass, Nehla Salil, and Pavitra Mohan Singh, Interns at Polstrat.

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.

Read more about Polstrat here. Follow us on Medium to keep up to date with Indian politics.