Rethinking India’s Energy Basket

The original version of the article was published on 13th July 2022 in “The Daily Guardian”

An ever-expanding Indian economy, continuously pushing for industrialisation and urbanisation, is witnessing a heightened demand for energy each passing year. Between 2000 and 2022, India alone accounted for more than 10 per cent of the increase in global energy demand. Moreover, energy demand in India, on a per capita basis, has grown by more than 60 per cent since 2000 with huge variations across states. As the country shifts towards a cleaner fuel-based economy, as part of its commitment to the Paris Climate Agreement (2015), several initiatives have been taken to replace fossil fuel-based energy generation with renewables. The initiatives range from cross-country partnerships such as the International Solar Alliance, to efforts aimed at the domestic energy market such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) II scheme.

Over the years, while there has been a considerable increase in the share of renewable energy in India’s energy basket, fossil fuels, primarily coal, continue to dominate India’s energy composition. This is coupled with a year-on-year increase in the installed capacity addition in coal-based power plants, along with other fossil fuels. Recent developments such as the Russia-Ukraine conflict have led natural gas and other fossil fuel prices to increase drastically and have compelled India to change its clean energy transition plans. A lot remains to be done to truly make the leap to a cleaner and environmentally sustainable future for India’s energy needs.

FOSSIL FUELS

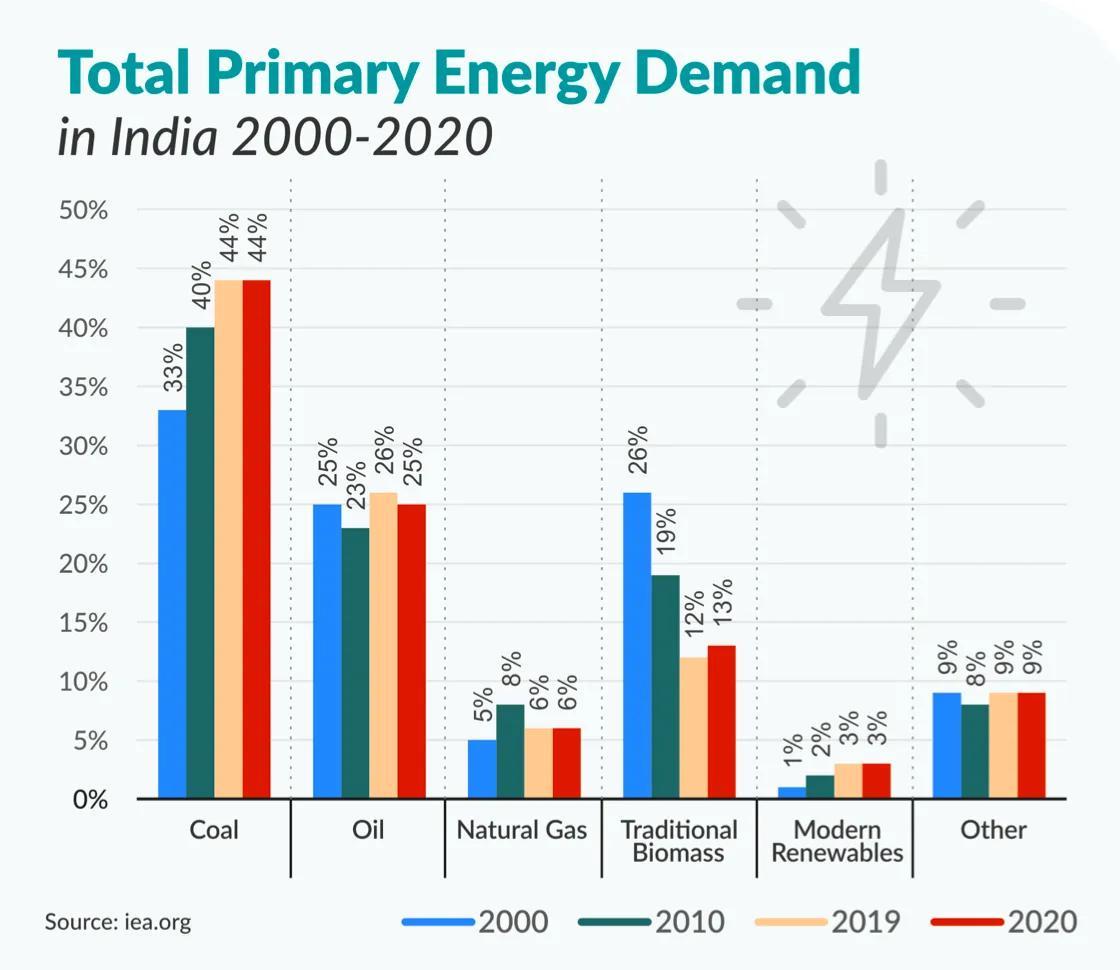

Over 80 per cent of India’s energy needs are met by three fuels: coal, crude oil, and solid biomass. Coal, one of the most polluting fossil fuels, is the mainstay of the Indian energy sector. As the demand for energy in India increased over the years, demand for coal has nearly tripled between 2000 and 2019. In 2020, coal accounted for 44 per cent of India’s primary energy demand, up from 33 per cent in 2000. Demand for crude oil, another key fossil fuel in India’s energy basket, is directly linked to rising vehicle ownership and road transport use. Despite increasing urbanisation and purchasing power of households, the demand for oil has remained consistent at 25 per cent between 2000 and 2020, but there has been a considerable increase in oil consumption in absolute terms. The share of natural gas, a relatively cleaner fossil fuel, (dubbed as the transition fuel in India’s plans to move away from coal) increased from 5 per cent in 2000 to 8 per cent in 2010, but fell to 6 per cent by 2020.

The central government’s push for cleaner cooking fuels through Ujjawala Yojana led to households in India moving towards Liquefied Petroleum Gas (LPG) as a fuel for cooking needs. This has nearly halved the share of traditional biomass as a source of energy from 26 per cent in 2000 to 13 per cent in 2020. Even though this is a big drop, according to the Indian Energy Exchange, 66 crore Indians have still not fully switched to modern, clean cooking fuels or technologies and continue to use biomass for their household energy needs. While there is potential for consumer demand for liquefied natural gas (LNG), another ‘clean’ fossil fuel, this need cannot always be met owing to several infrastructural bottlenecks and pricing constraints.

CASE FOR RENEWABLES

Even as India has pushed for a cleaner and greener economy by shifting to cleaner fuels, renewable energy’s share in India’s energy composition has remained near 9 per cent in the two decades between 2000 and 2020. However, within renewable energy sources, there has been a considerable shift toward solar energy over the years. This is because of both the central government’s push in favour of solar energy and the falling costs of installing solar energy equipment such as solar panels and photovoltaic cells. As of March 2022, renewable energy formed a quarter of India’s total installed power capacity and accounts for 13 per cent of the country’s electricity generation.

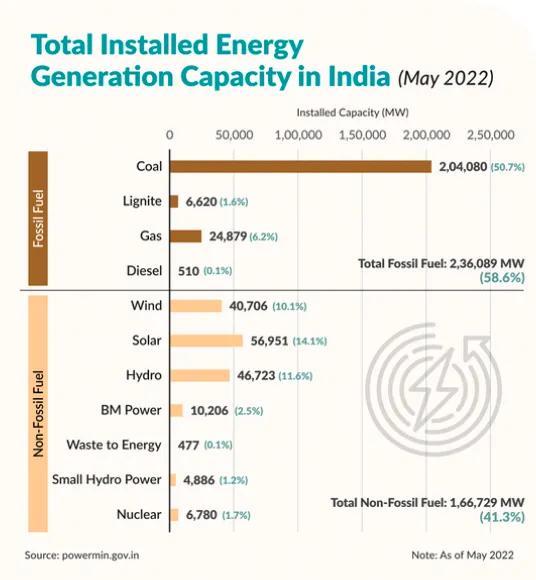

According to the Central Electricity Authority (CEA), total non-fossil fuel installed energy capacity in India, as of May 2022, was 1,66,729 megawatts (MW) or 41.4 per cent of India’s total installed capacity. Within this, solar energy has the highest share at 14.1 per cent followed by hydro at 11.6 per cent and wind at 10.1 per cent. Waste to energy contributes the least to renewable energy in India at just 0.1 per cent of the total installed capacity.

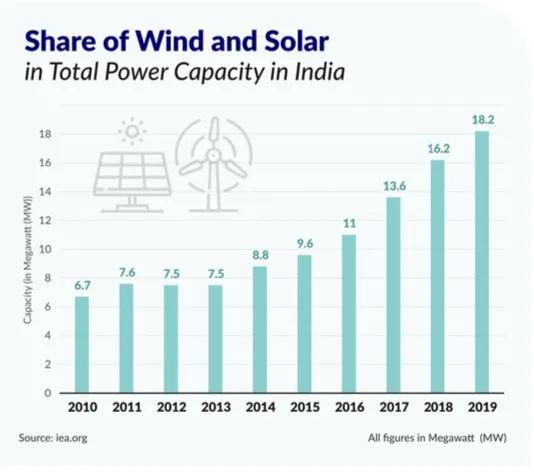

Renewables, including hydro power but excluding nuclear energy, comprise 39.6 per cent of India’s total installed capacity. With the Indian government’s concerted efforts to push India towards a fossil fuel free economy, a total of 65.6 gigawatts (GW) of solar and wind capacity has been added to the grid since the beginning of the fiscal year 2015–16 (solar and wind energy are increasingly emerging as the prime sources of renewable energy in India). In the fiscal year ending March 2022 alone, India added a record 13.9 GW of solar capacity to the grid. Interestingly, in 2019, India added nearly five times as much solar capacity as it did in 2015. A key driver of the increasing reliance on solar energy as the most viable form of renewable fuel has been the global decline in costs.

FALLBACK IN CLIMATE COMMITMENTS

At the 26th Conference of Parties (CoP26), Prime Minister Narendra Modi declared a five-fold strategy — termed as the panchamrita — to transition India towards a cleaner and greener economy. The five-fold strategy included bringing non-fossil energy capacity down to 500 GW and meeting 50 per cent of India’s energy requirements from renewable energy by 2030 as two key measures. The commitments aimed to reduce the total projected carbon emissions of the country by one billion tonnes from 2016 onwards and reduce the carbon intensity of the Indian economy by less than 45 per cent by 2030.

As a part of the climate commitments made in 2016, India set a target of adding 175 GW of renewable energy capacity by 2022, comprising 100 GW of solar energy, 60 GW of wind energy, 10 GW of biomass power, and five GW of small hydropower. With just five months remaining in 2022, only around 57 per cent of the 100 GW solar target and 67 per cent of the 60 GW wind target has been met. India is projected to miss its 2022 solar and wind capacity targets by about 27 per cent and 18 per cent, respectively.

CLEANER AND GREENER ECONOMY

Between 2015 and now, India’s efforts towards advancing its transition to clean energy and mobility include its determined contribution to installing 500 GW of renewable energy capacity by 2030. The FAME II scheme is one such measure aimed at promoting the switch from petrol/diesel-based private vehicles to electric vehicles and involves a subsidy component to the purchaser of the electric vehicle in the form of an upfront price reduction. The National Electricity Plan 2018 is another such measure. It includes a timeline of retiring coal power plants older than 25 years in two phases, along with plans to reduce around 48 GW of coal capacity between 2017 and 2027 (CEA, 2018). In May 2018, the Indian government announced a National Wind-Solar Hybrid Policy to promote large grid-connected wind-solar photovoltaic (PV) hybrid systems. The policy aims at promoting new and innovative technologies and methods for combining wind and solar power.

The world’s largest renewable energy park of 30 GW capacity (a solar-wind hybrid project) is currently undergoing installation in Gujarat. Globally, India is ranked third for total renewable power capacity additions with 15.4 GW in 2021, following China (136 GW), and the United States (43 GW). Measures to push renewables, which include increasing government allocation for Production Linked Incentive (PLI) schemes to boost the manufacturing of high-efficiency solar modules, have added to India’s efforts for cleaner fuel. In June 2021, a global initiative to accelerate clean energy innovation among countries called Mission Innovation CleanTech Exchange was also launched.

Other indirect initiatives of the central government include Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) to support the installation of off-grid solar pumps in rural areas and reduce dependence on the grid in grid-connected areas; SAUBHAGYA scheme to provide electricity to Indian households; Solar Charkha Mission (employment generation for nearly one lakh people through solar charkha clusters in rural areas); National Solar Mission and Renewable purchase obligation (RPO) — the mechanism by which distribution companies are obligated to purchase a certain percentage of power from renewable energy sources, among other measures.

FULL POWER AHEAD

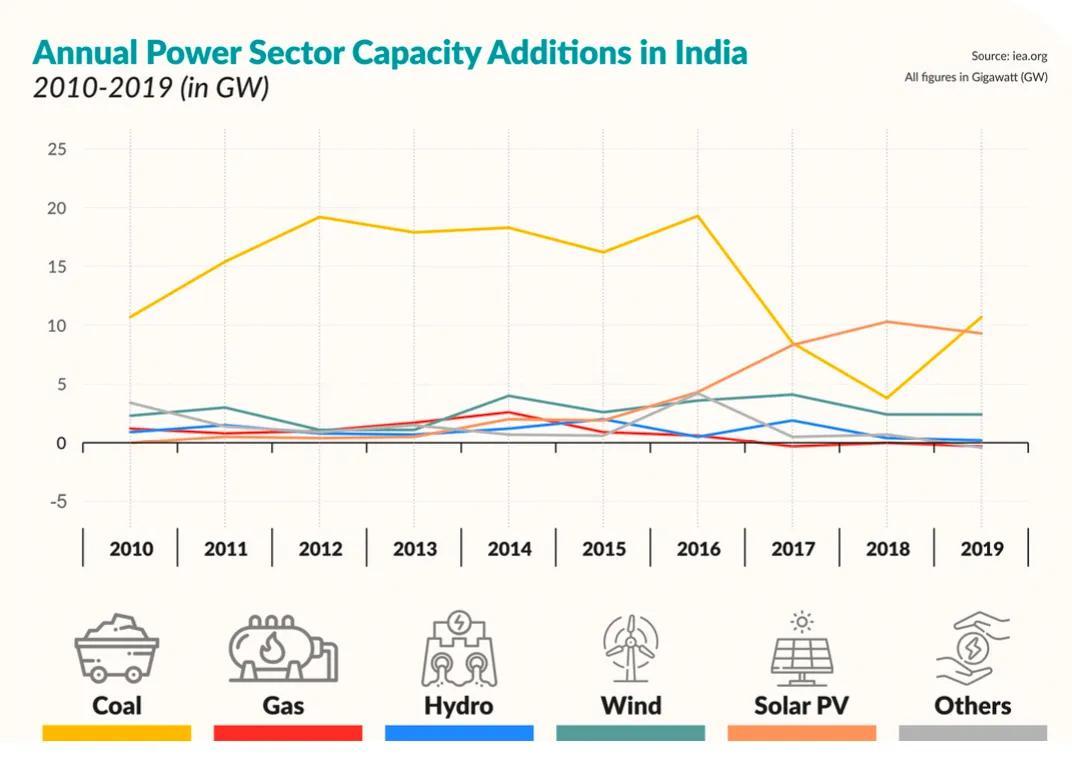

Tremendous growth in renewable energy sources in India has tempered the growth in coal capacity, but has neither prevented the increase nor replaced it. Between 2015 and 2019, the rise in installed coal-fired capacity was higher than that of solar and wind (58 GW coal thermal capacity installed versus 49 GW solar and wind). This was in spite of renewables outpacing coal-fired capacity additions since 2017, coupled with a number of cancellations of approved coal projects.

According to the Central Electricity Authority (CEA), the main advisory body for the central government on policy matters and electricity systems, the country’s installed capacity of non-fossil energy for electricity generation — solar, wind, hydel, and nuclear will increase from 134 GW in 2019 to 522 GW in 2030. This will require solar and wind energy installed capacity to increase to 280 GW and 140 GW, respectively. While India has reduced support to the fossil fuel industry over the years, increasing demand for energy, external factors such as rise in prices of gas, and India’s dependence on imports for solar energy equipment have been major roadblocks in India’s transition to clean energy.

Damini Mehta/New Delhi

Contributing reports by Anvy Shrivastava, Shubhangi Jain, and Nehla Salil, Researchers at Polstrat

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.

Read more about Polstrat here. Follow us on Medium to keep up to date with Indian politics.