Status of the Indian Economy

The original version of the article was published on 28th September 2022 in “The Daily Guardian”

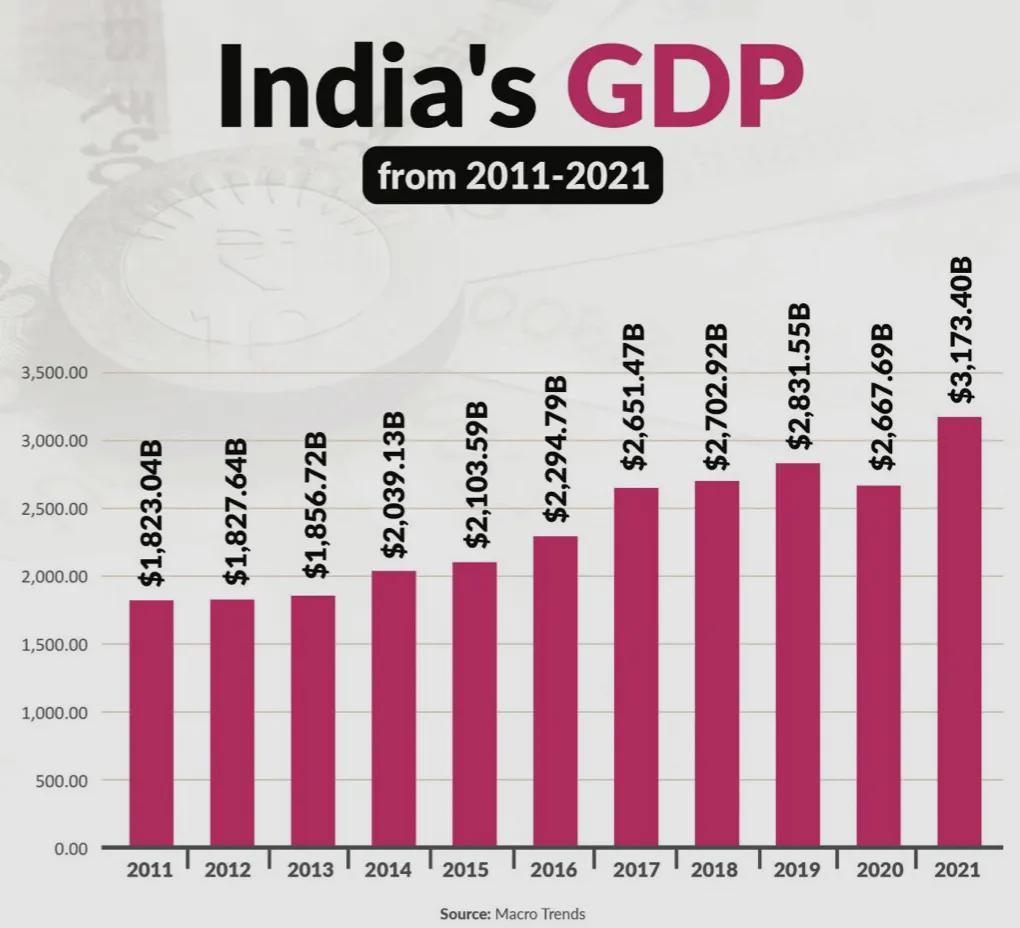

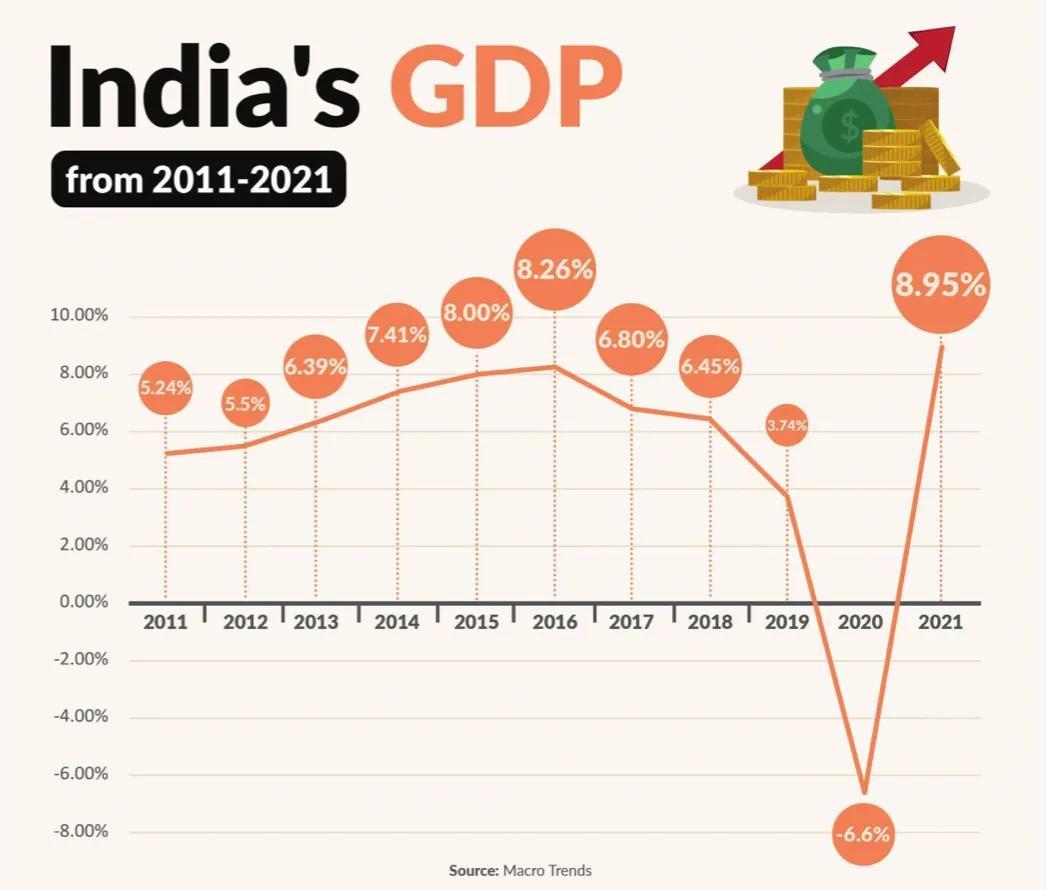

As Indians head into the festive season for the year, alarmingly increasing prices of food items and rising unemployment in August have raised concerns about the state of the Indian economy over the last few months. The economy recovered from the economic impact of the Covid-19 pandemic much faster than most other countries in 2021. In 2022, the increase in private consumption along with the revival of growth sectors such as travel, tourism, and hospitality along with investments in infrastructure, technology services, and manufacturing contributed to an optimistic outlook of the growth rate in the economy for the 2022–23 financial year. However, challenges such as a major heatwave which impacted crop production, high inflation due to high oil prices, increasing geopolitical tensions between Russia and Ukraine, and depreciation of the rupee are factors that have proven to be challenging to the growth of the Indian economy so far this year. As we head into the 2022 festive season, let us have a look at some of the major economic indicators, including inflation, unemployment, and what they signal for the state of the Indian economy moving forward.

Amid surging inflation, are Households worried as we head into the festive season?

In 2022 so far, inflation has remained above the Reserve Bank of India’s (RBI) target upper limit of 6 per cent, surging to a high of 7 per cent in August last month. The rate of inflation in the country had fallen from a high of 7.8 per cent in April this year to 7.01 per cent in June and further to 6.71 per cent in July after the RBI introduced a series of repo rate cuts to ease the inflationary pressures on the economy. However, despite this, inflation in August was recorded at 7 per cent, driven by an increase in food prices, which comprises 60 per cent of the basket of goods in the Consumer Price Index (CPI). In the food category for the month of August, inflation was recorded at 7.6 per cent, driven by an increase in the prices of cereals, milk, fruits, and vegetables. Economists also state that with kharif production this year predicted to be relatively lower, food prices are likely to increase further. Overall, the inflationary pressure on the economy also seems broad-based, as all segments have recorded an inflation rate of above 6 per cent for August.

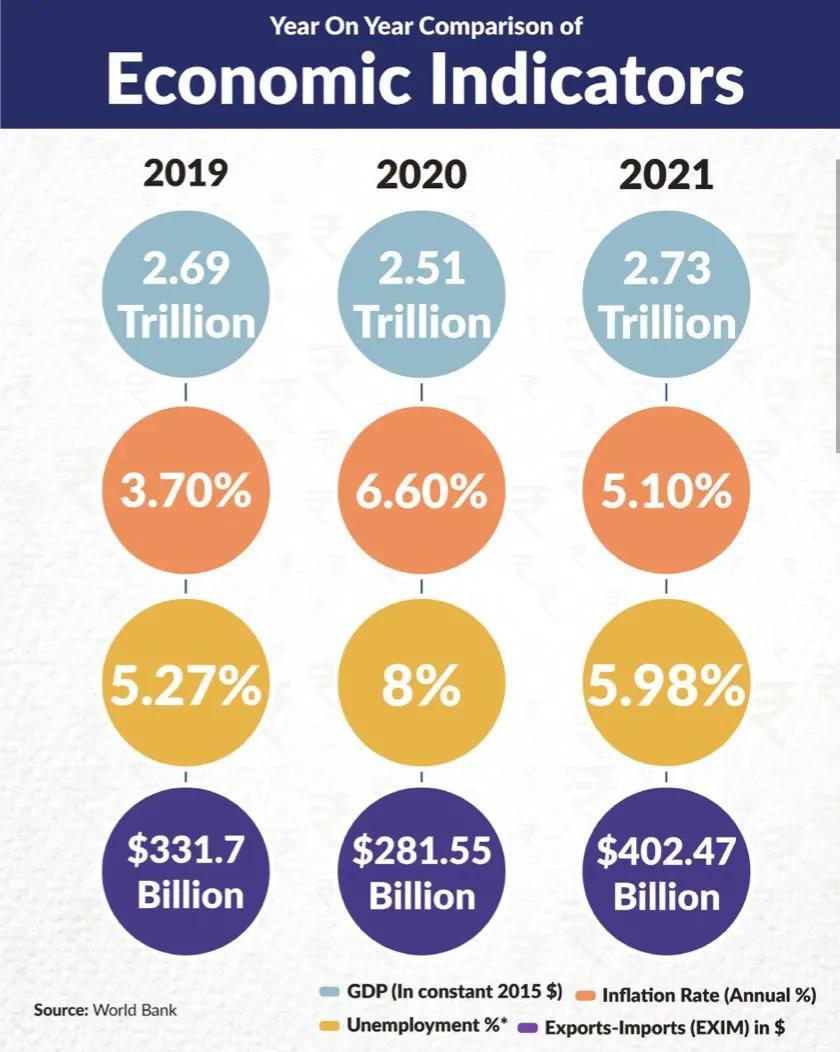

The inflation rate in 2022 so far has been considerably higher than the last financial year, during which the average inflation in India was 5.13 per cent, a decline of around 1.49 per cent from 2020. This was attributed to the sharp rise in commodity prices worldwide, driven by supply change disruptions caused by the COVID-19 pandemic. Prices of crude oil and vegetable oil (both of which are major exports in the global market) shot up, while metal prices were at a 10-year high along with rising freight costs and overall food prices. As per predictions by Deutsche Bank, India’s headline retail inflation is likely to rise further to a five-month high of 7.4 percent in September, due to the rising prices of food and vegetables. Experts also state that the RBI is likely to raise interest rates for the fourth time in a row on 30th September in order to help lower inflationary pressures on the economy.

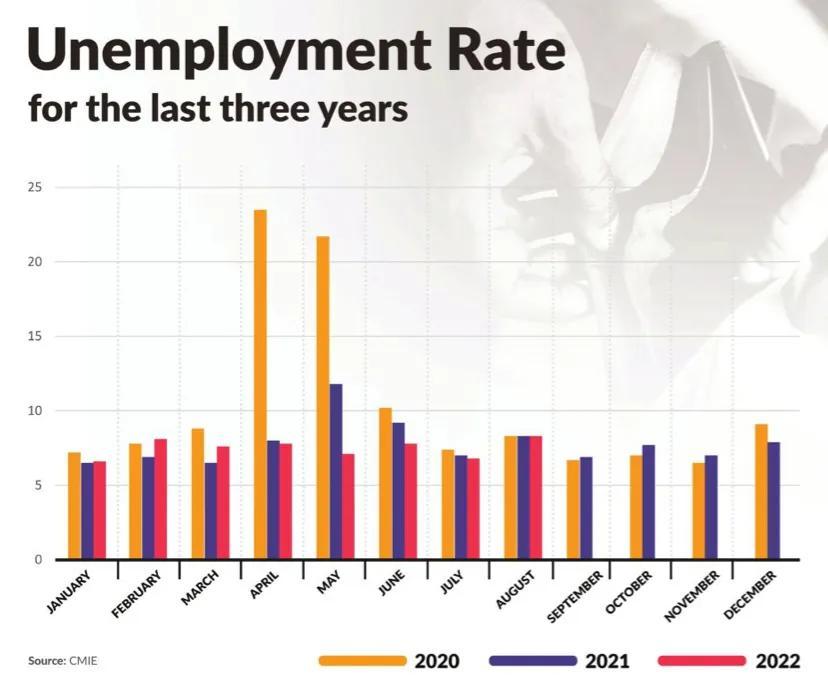

Highest unemployment rate recorded in August

In 2022 so far, the highest rate of unemployment was recorded in August at 8.28 per cent, while the lowest rate was recorded at the beginning of the year in January at 6.56 per cent. Overall, the average rate of unemployment in 2021 was 5.98 per cent, while the number was 8 per cent in 2020. The unemployment rate recorded in August was the highest it has been in a year. For the same month, the employment rate also declined from 37.6 per cent to 37.3 per cent. As per data by the Centre for Monitoring Indian Economy Pvt. Ltd. (CMIE), the unemployment rate in urban areas (around 8 per cent) is usually higher than that in rural areas (around 7 per cent). However, for the month of August, the unemployment rate in urban areas was around 9.6 per cent, while the rural unemployment rate was around 7.7 per cent. While unemployment varies significantly by state, the highest rates were recorded in Haryana at 37.3 per cent, followed by Jammu and Kashmir at 32.8 per cent, Rajasthan at 31.4 per cent, Jharkhand at 17.3 per cent, and Tripura at 16.3 per cent.

CMIE data also revealed that the decline in the labour market is due to a decline in salaried jobs along with an increase in the number in the labour force. As per the data, for the month of August, the Indian labour force grew by 4 million, while the labour market lost around 2.1 million jobs, causing an increase in the total unemployed to 35.6 million. It is important to note that the overall decline in salaried jobs in particular stands at 4.6 million, the lowest it has been in 15 months. The agricultural sector also lost 11 million jobs in the month of August. However, non-farm services and informal jobs increased by around 2 million. Given the onset of the festive season, salaried jobs are expected to rise back up to over 80 million in September, which is predicted to absorb the growth in the labour force.

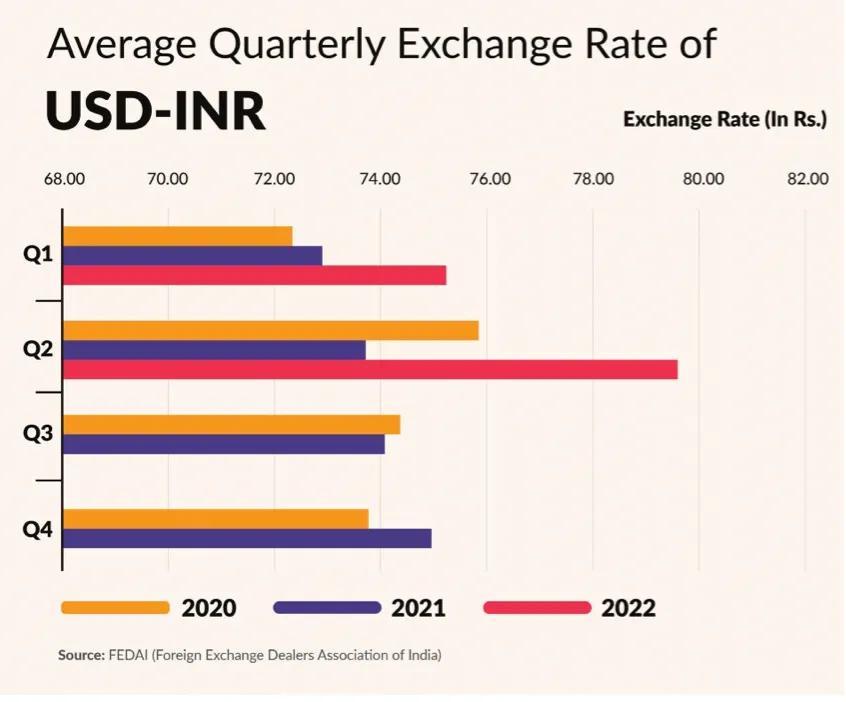

Will the rupee continue to decline?

On 26th September, the rupee depreciated to an all-time low of 81.50 against the US dollar as markets closed on Monday. The average exchange rate for the US dollar in 2022 was at around 74.13 rupees, while in 2021 this was at around 73.9 rupees. However, so far in 2022, the average exchange rate has gone up to 78.29 rupees. The decline of the rupee against the US dollar is not isolated, it comes in line with the massive fall of global currencies against the dollar continuing in the global market. The value of the US dollar against other major currencies has reached the highest level since the early 2000s. The major reason for this is the high rate of interest being offered by the Federal Reserve in order to combat inflationary pressures in the United States economy.

In a written statement to the parliament in July earlier this year, Indian Finance Minister Nirmala Sitharaman attributed the rupee’s fall to various external factors such as the ongoing Russia-Ukraine war, increasing prices of crude oil and the tightening of global financial conditions. The depreciation of the Indian rupee can be attributed to these factors. As per the Japanese financial holding company Nomura, for every $1 increase in the price of oil, India’s import bill increases by $2.1 billion. Market analysts from the investment bank Goldman Sachs predict that as geopolitical conditions continue to remain unpredictable in the next few months and the Federal Reserve continues tightening its policy, the rupee will likely continue weakening in the next few months. The bank forecasts the Indian currency will continue to be in the 80–81 range per dollar for the next three to six months.

Growth Forecast

For the 2022–23 financial year, the International Monetary Fund (IMF) predicted a growth forecast of 9 per cent, while the Economic Survey announced in February 2022, pegged the same at 8–8.5 per cent. However, following the first quarter of the financial year, the IMF cut down this estimate to 8.2 per cent in April and then further to 7.4 per cent in July 2022. Several other banks, including Goldman Sachs have lowered the economic growth predictions for India from 7.2 per cent to 7 per cent, while the Asian Development Bank (ADB) has also slashed predictions to the same.

The Governor of the Reserve Bank of India (RBI) Shaktikanta Das, has strongly maintained his forecast of 7.2 per cent GDP growth rate for the 2022–23 financial year. A combination of factors, including rising interest rates to combat inflation, uneven monsoon season, and overall global slowdown in economic growth are all likely to continue to have an impact on the growth of the Indian economy in the next few months.

Shreya Maskara/New Delhi

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.

Read more about Polstrat here. Follow us on Medium to keep up to date with Indian politics.