Surging EPFO Subscribers: A Sign of Formalisation

The original version of the article was published on 26th May 2023 in “The Daily Guardian.

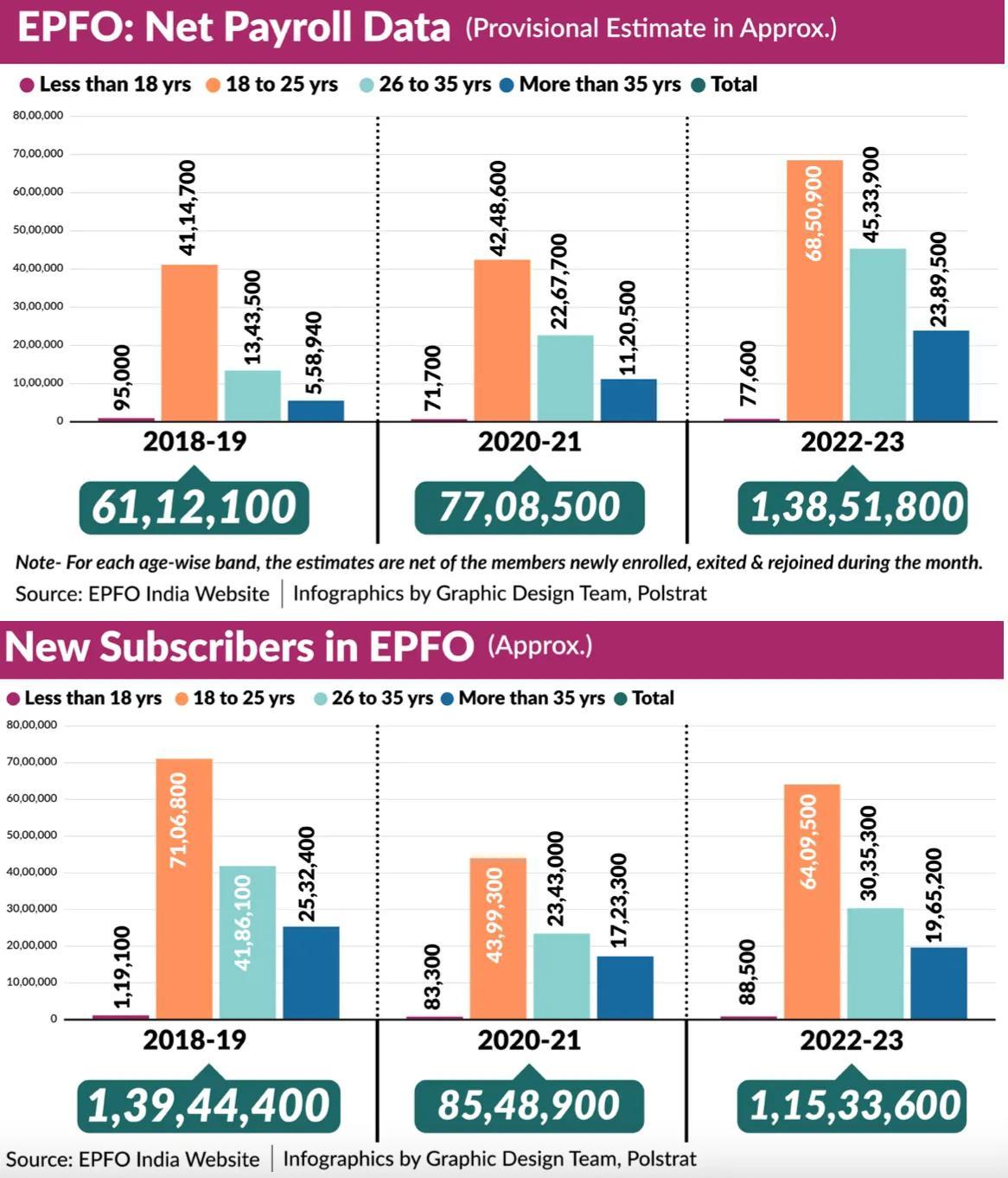

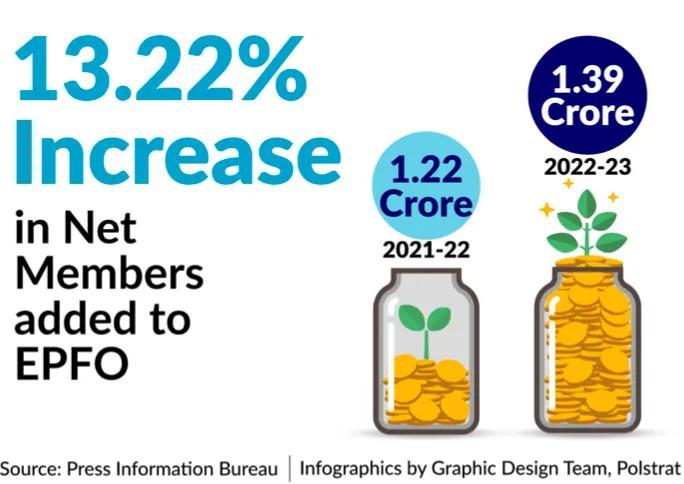

The Employees' Provident Fund Organisation (EPFO) plays a vital role in securing the financial well-being of crores of organised and semi-organised sector employees across India. In recent years, EPFO experienced a remarkable increase in its subscriber base, underscoring a significant trend towards the formalisation of the Indian economy. Between financial years (FY) 2021-22 and 2022-23, new subscribers that joined the Employees' Provident Fund (EPF) increased by 5.8 per cent from 1.08 crores in FY22 to 1.15 crores in FY23. This records the largest increase in new subscribers joining the social security organisation in a year since FY19.

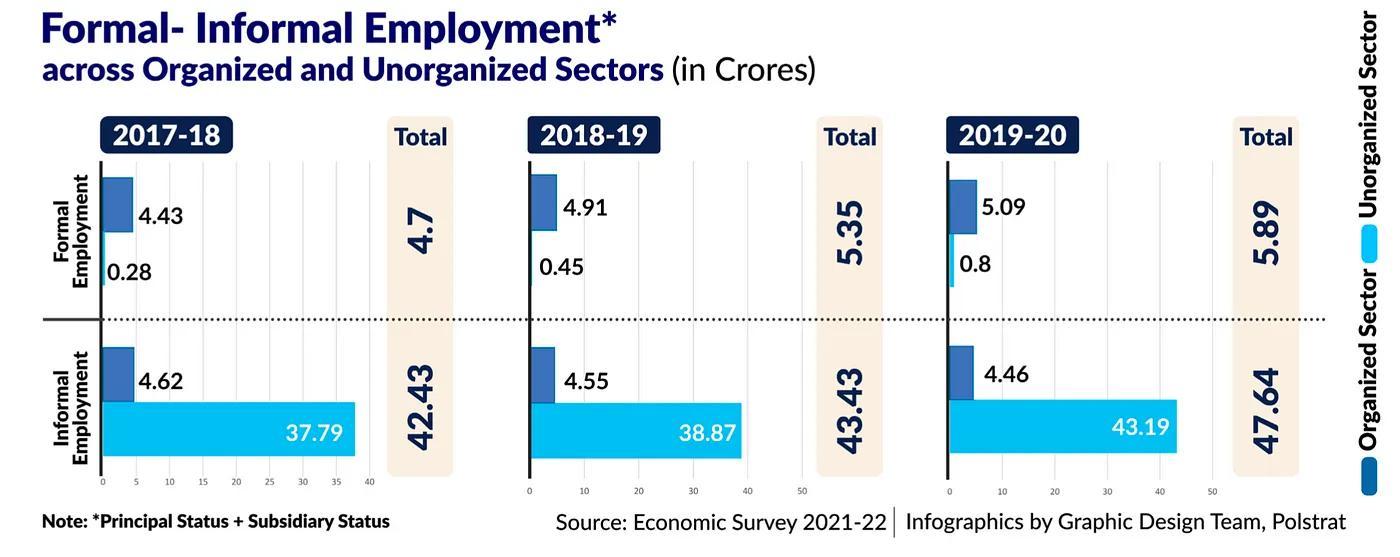

The increase in the EPFO's membership is being attributed to a number of factors, such as the growth of the organised sector in India, the government's focus on formalising the economy and increasing awareness of the benefits of social security. This article delves into the data and facts behind the surge in EPFO subscribers, encompassing gender, age, and occupational breakdowns while shedding light on how this upswing signifies the ongoing formalisation process.

Growing Gender Parity?

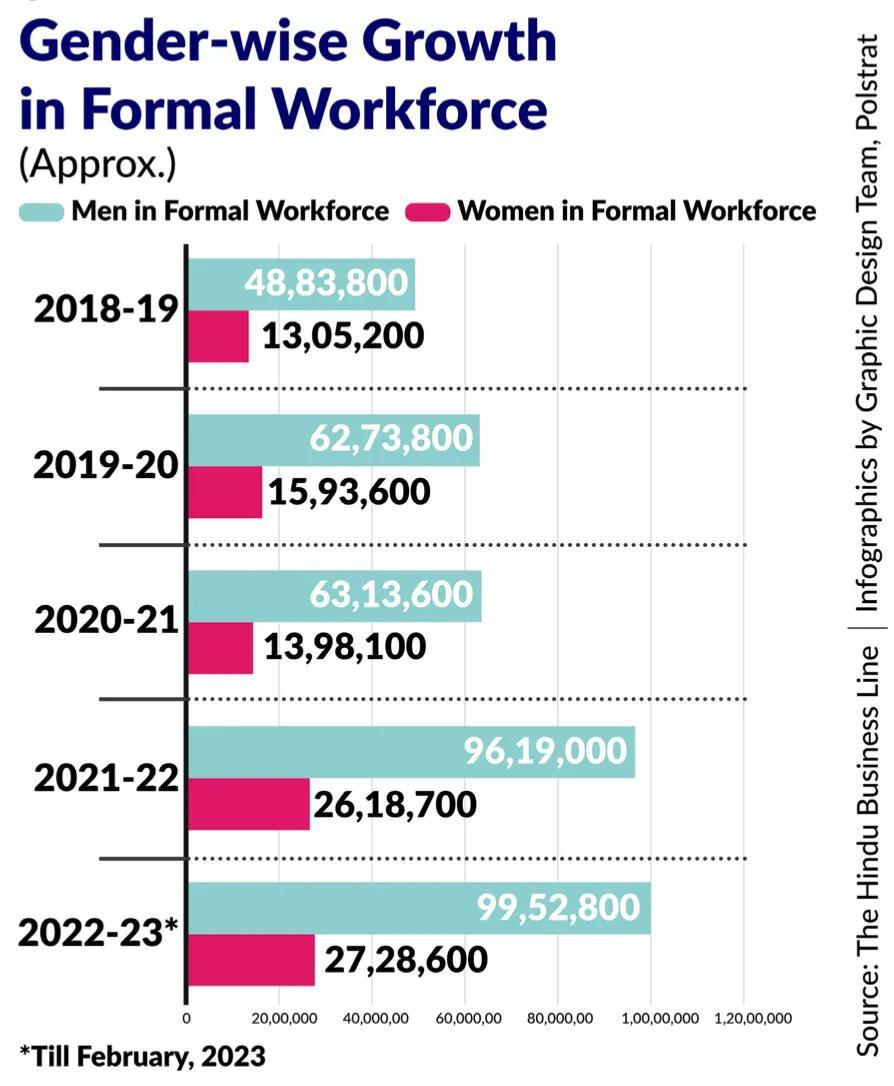

One noteworthy aspect of the rise in EPFO subscribers is the increasing participation of women in the workforce. Traditionally, women in India have faced barriers to formal employment. However, EPFO payroll data reveals a promising trend as more women are now contributing to their retirement savings through organised channels. This rise in female subscribers can be attributed to increased education and awareness, improved opportunities, and the government's emphasis on women's empowerment. The share of women among new subscribers grew steadily over the last five years to 26 per cent from 21 per cent in FY19, illustrating a progressive shift towards gender parity in the Indian labour market. Notably, in the five years between 2018-19 and 2022-23, the share of women in the formal workforce increased by nearly 108 per cent from 13 lakh to 27 lakh. This shift for male workers was recorded at 103 per cent during the same period.

However, in spite of the increasing share of women as subscribers to EPFO schemes, EPFO's membership is predominantly male, with 78 per cent of the members being male and 21 per cent being female.

Shifting Winds of Social Security

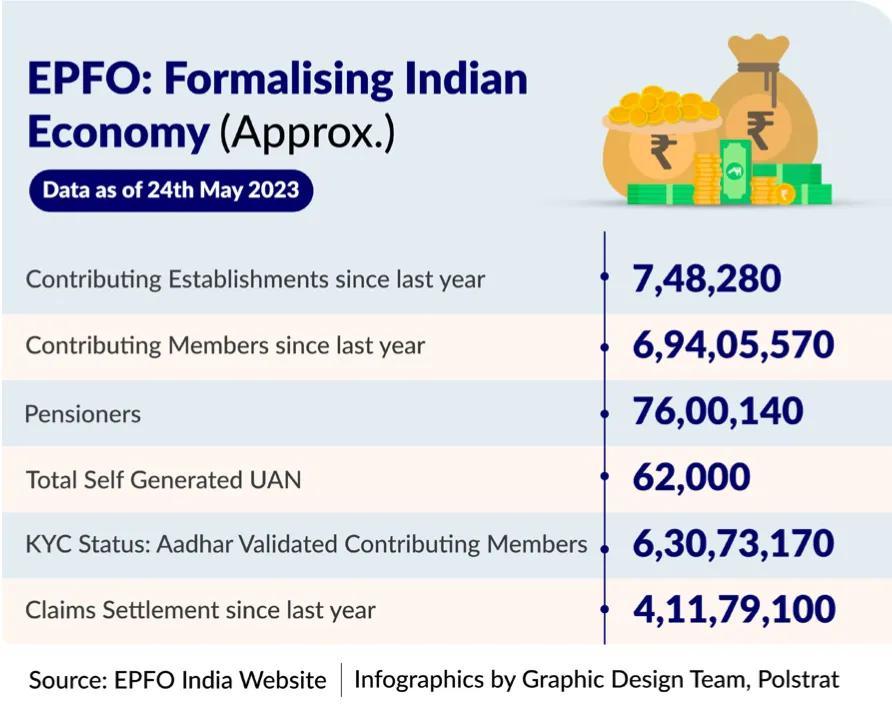

The EPFO caters to workers in medium and large establishments of the formal sector. With 6.9 crore monthly contributors on an average and over 71 lakh pensioners receiving their due every month, EPFO manages a corpus upwards of ₹17 trillion. EPFO's corpus is a mix of debt investments worth ₹14.46 trillion and relatively recent equity investments worth ₹1.23 trillion. Statutory conditions for formal sector employers to subscribe to EPFO have also contributed to the organisation's large corpus and membership. According to a report from November 2021, by asset size, EPFO ranks 8th among all sovereign pension funds, 18th among all pension and investment funds, and 33rd among all top asset owners of the world.

The number of subscribers who left and returned to EPFO schemes rose by 13.21 per cent to 1.38 crore in FY23, establishing the increasing relevance of actively contributing to social security in India. According to the EPFO website, more than 7.48 lakh establishments comply with the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 in the last year.

Moreover, integrating the e-Shram portal for unorganised workers with the EPFO, which caters to semi-organised and organised sector employees, has facilitated the seamless movement of employment from the informal to the formal sector. This was done by making the universal account number of 280 million unorganised workers on the e-Shram portal portable with the EPFO. It is also in line with the government's vision to extend the social security net universally to all types of workers in India.

Damini Mehta/New Delhi

Contributing Reports by Shubhangi Jain, Swati Sinha, Raunaq Ali and Sreetama Neogi, Researchers at Polstrat

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.