The Indian Economy in 2021: Year in Review

The Original Version of this article was published on 15th December 2021 in “The Daily Guardian.”

At the beginning of 2021, as the Indian economy had just begun to recover from the devastating impact of the first wave of the COVID-19 pandemic, towards the end of March, the second wave of infections took over the country, prompting localised lockdowns across the country. The economy, battered by the impact of the first wave, had recorded the biggest contraction in economic growth in almost 40 years. As the second wave of the pandemic surged across the country, it was much deadlier than the first. However, for the Indian economy, the overall shock of the second wave across many indicators has been weaker than the second wave. Since the summer of 2021, growth in the country has recovered, due to high demand for exports and overall consumer demand. Similarly, the continued decline in COVID-19 cases, combined with an increase in the rate of vaccination, has prompted greater consumer confidence. Other overall positive signs of recovery in the Indian economy include a revival of the manufacturing sector and record agricultural production. However, some indicators, including the unemployment rate and labour force participation rate, paint a worrisome picture with the impact of the second wave, particularly on the structure of employment in the country. Let us have a look at some of the major economic indicators, including Gross Domestic Product (GDP), retail inflation, unemployment, Labour Force Participation Rate (LFPR,) and the trade deficit to see how the Indian economy has performed so far in 2021.

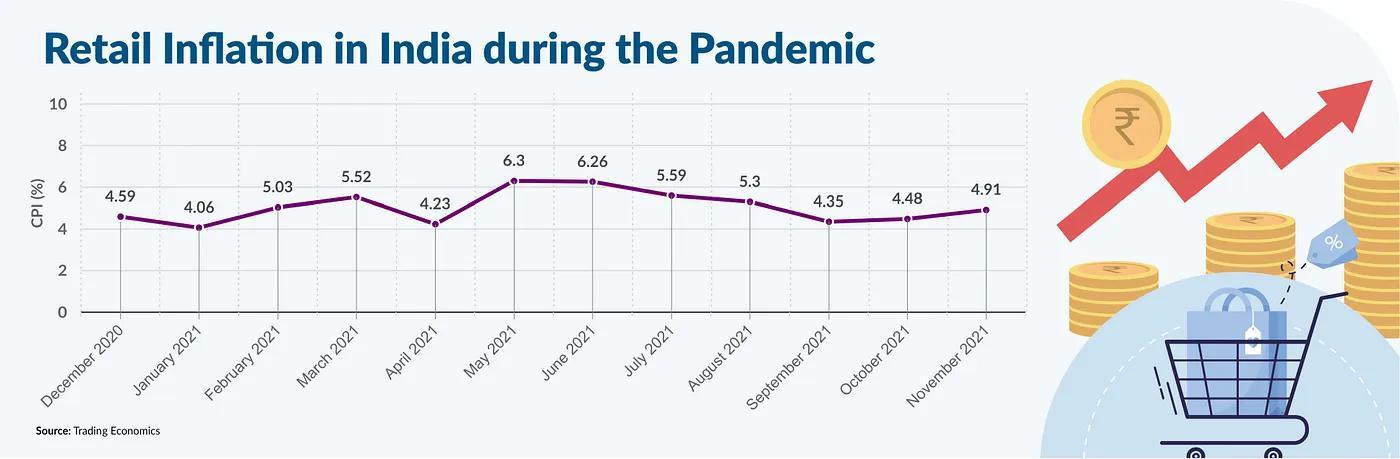

Inflation in 2021: Fluctuating Indicator

As per inflation data released by the Ministry of Statistics and Programme Implementation on 13 December, India’s benchmark inflation rate, measured by the Consumer Price Index (CPI), firmed up to 4.91% year-on-year in November. Given this, the inflation rate of the country has remained at the tolerance level of 2%-6% for five consecutive months this year.

At the beginning of the year, as overall COVID-19 cases began to subside and the economy started showing signs of recovery, inflation in the first four months of the year stood well within the RBI’s target of 2%-6%. However, towards the end of March, as the number of COVID-19 cases began to rise in the country, states and governments decided to impose stringent lockdowns which disrupted the movement of goods and services, thereby having a direct impact on the inflation rate. Following the second wave and its effect on supply chains, inflation rates climbed to 6.3% in May and 6.26% in June. The continued increase in prices of food and fuel put pressure on both businesses and households, sparking protests across the country.

After August, as the economy began to gradually open up and recover, the inflation rate also subsided, touching 4.35% in September, the lowest retail inflation recorded since April 2021. Economists suggested that the decline in food prices, particularly of vegetables and cereals helped ease the inflationary pressure. Additionally, a good monsoon season, resumption of agriculture supply chains, and administrative steps such as low import duties on edible oils all contributed to the lowering of inflation. The Reserve Bank of India (RBI) MPC expects the increase in vegetable prices to reverse with the winter arrivals and expects CPI at 5.1% for the third quarter and 5.7% for the fourth quarter of this financial year.

Overall, food inflation fell significantly from above 5% at the start of the current financial year to 0.7% in September 2021. During the same period, fuel inflation rose from 8% to 13.6%. While overall inflation declined for all income classes in this fiscal year 2021–22 compared with the last, the urban poor (bottom 20%) bore the heaviest brunt in both time periods.

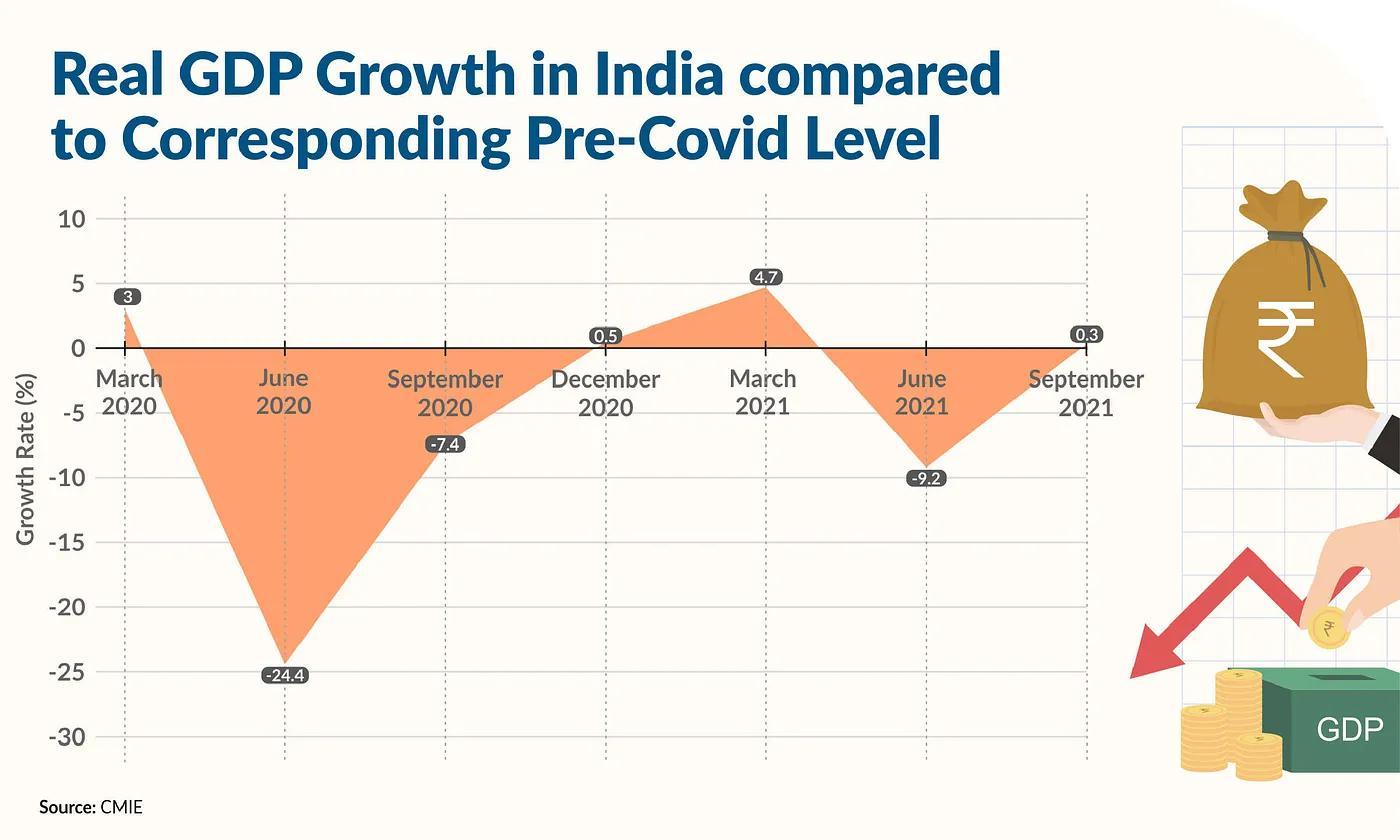

Economic growth: Recovery Year

In May 2021, the National Statistical Office (NSO) released numbers for the overall changes in Gross Domestic Product (GDP) for the fiscal year 2020–21 which showcased that the Indian economy contracted by a whopping 7.3 per cent. This was the most severe contraction in the economy since Indian Independence and India had been among the world’s major economies to be hit hardest by the pandemic. The impact of the first wave of the pandemic was felt in each sector of the economy and many anticipated that the second wave of the pandemic was likely to have an even more devastating impact on the Indian economy.

Indian GDP actually grew by 1.6 per cent in the January-March period, up from 0.5 per cent in the previous quarter when India began pulling out of a steep pandemic-induced recession in the previous six months. Similarly, GDP actually grew by 20.1% for the April to June quarter in 2021 compared to a year earlier. During the same period last year, India’s economy shrank by 24%. Overall projects for economic growth for the country for the 2022 financial year have been dented due to the low base of 7.3% contraction (2020–21). However, various economic analysts and brokerage houses have already revised their estimates for the economic growth figures for 2022 due to a rise in consumer spending, a fall in COVID-19 cases and an increased speed of vaccination.

For instance, Goldman Sachs revised its projections for Indian GDP from 8% to 9.1% for the 2022 financial year. Similarly, SBI Research increased its forecast of GDP growth to 9.3–9.6% for 2022 from its earlier prediction of 8.5–9%. Similarly, the RBI has also announced that the GDP growth target for this year is likely to be around 9.5%. It can be said that overall, the impact of the second wave of COVID-19 on economic growth was less severe as compared to the first wave. Although the economy suffered, localised lockdowns instead of national lockdowns and greater activity across crucial sectors reduced overall economic damage

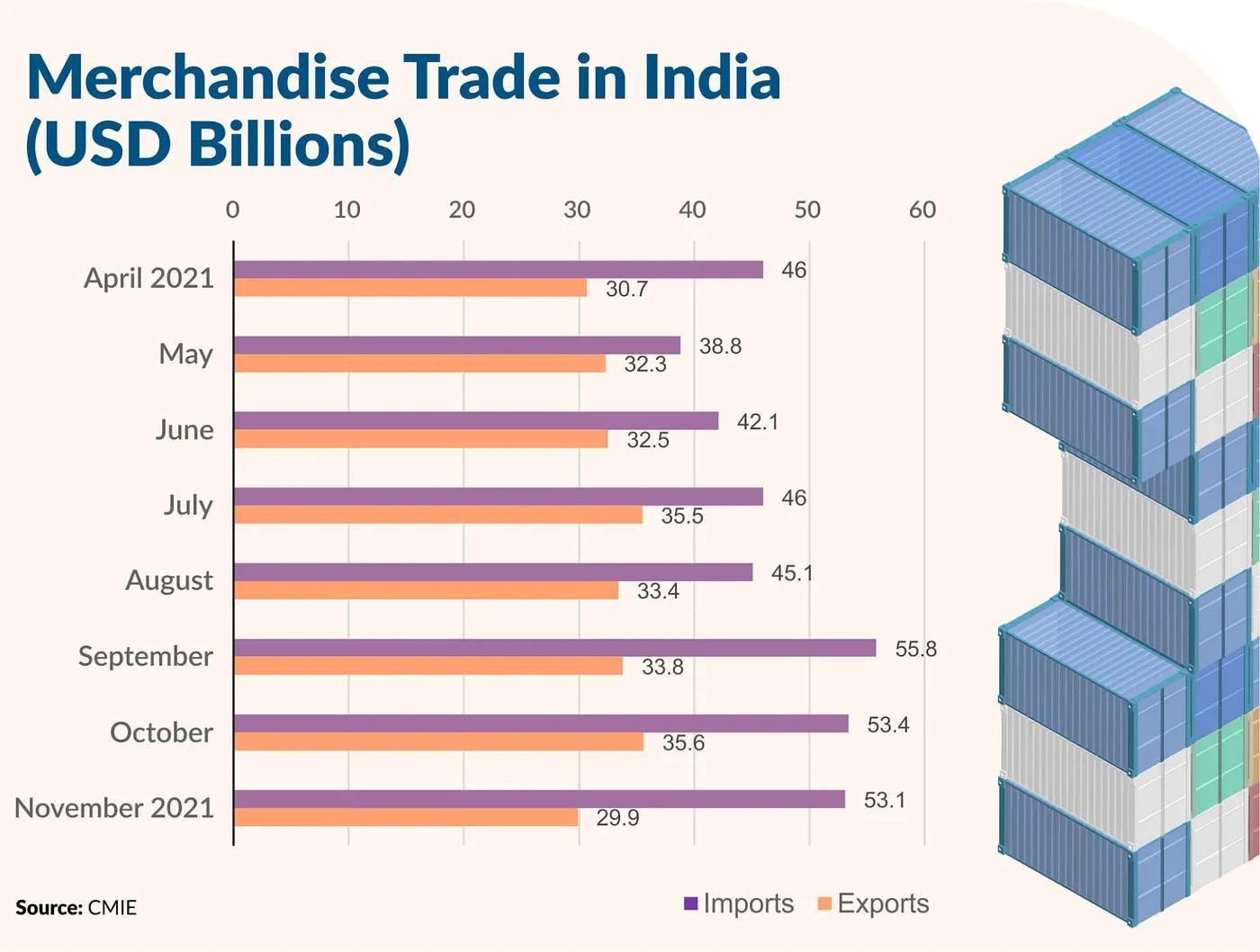

India’s Trade Figures Show Resilience in 2021

Overall, United Nations data indicates that India is one of the few countries that has performed better than major economies in the world in terms of trade in the first quarter of 2021. While the import of goods grew by 45% in the first quarter over the year 2021, exports grew by 26%. Overall, India’s exports in April 2021 were recorded at $30.63 billion, as compared to $10.36 billion in April 2020, exhibiting a growth of 195.72%. Even after the second COVID-19 wave hit the country, India’s merchandise trade has shown resilience. Exports rose in June 2021 by 48.3 per cent to $32.5 billion compared to June 2020. These are also the second-highest monthly exports recorded by the country so far. Experts suggest that the growth in merchandise exports was due to the rising demand from various developed countries where the impact of COVID-19 had already started to decline during this period.

Overall, India’s merchandise trade deficit widened to a record $22.59 billion in September, the highest in at least about 14 years led by engineering goods, petroleum products, plastics, and cotton yarn. India’s merchandise exports increased for the twelfth consecutive month in November and grew 26.49% this year at $29.88 billion. However, sequentially, exports declined 16% to $29.88 billion in November from $35.65 billion. Official data also showed a 57.18% rise in imports leaving an all-time trade deficit of $23.27 billion compared to $10.19 billion in November 2020.

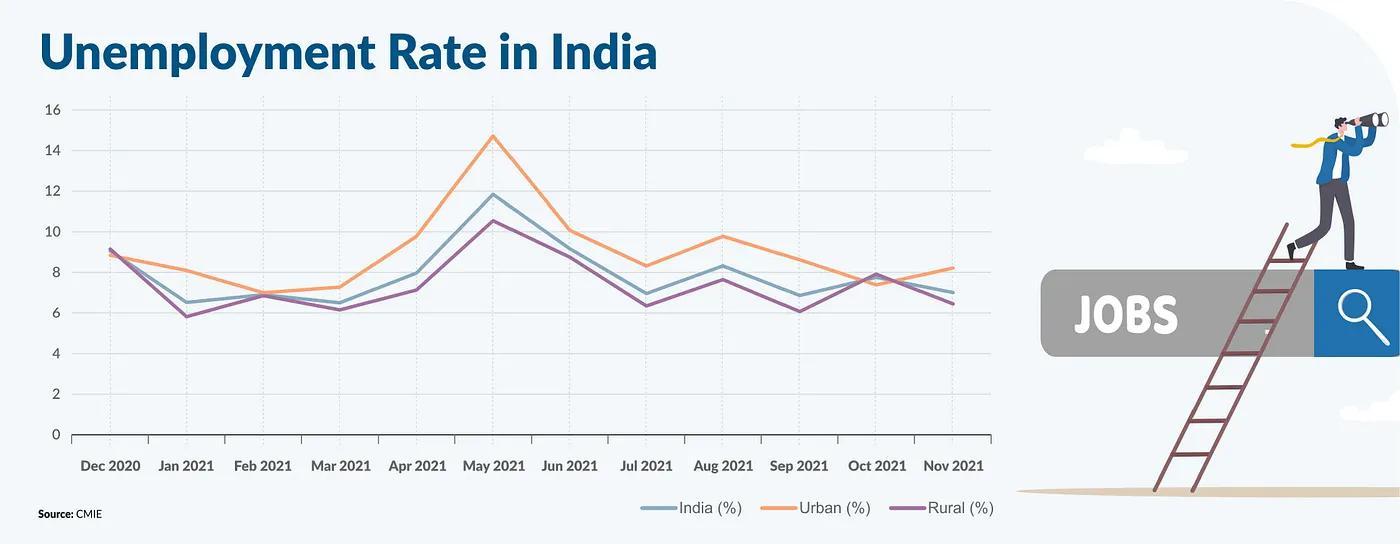

Unemployment in 2021: Worrisome Picture

Earlier in the year, prior to the onslaught of the second wave of the COVID-19 pandemic as per the Periodic Labour Force Surveys (PLFS) data, available for January-March 2021, the unemployment rate in urban India was 9.4%. While this figure was lower than the previous quarter (10.3%), it was 0.3 % higher than the figure recorded for the same quarter in 2020, prior to the first wave of the pandemic. Youth unemployment continued to be high across states in the first quarter, a continuing trend that has been visible since 2020 in the 15–29 years age group

During the first nationwide lockdown announced in March 2020 following the first spike in COVID-19 cases, the unemployment rate touched a record high of 23.5% in May 2020 (the highest since 1991). In 2021, although a nationwide lockdown was not announced, all state governments announced lockdowns and during the second wave, the economic impact of lockdown was felt in rural areas as much as in urban areas. The unemployment rate, which had steadily been declining in the first quarter of the year, peaked in May 2021 at 11.84%, translating to job losses for roughly one crore Indians during the second wave of the pandemic.

June onwards, the second wave of COVID-19 has ebbed and restrictions on mobility have reduced. Correspondingly, labour markets have started improving slowly and the unemployment rate lowered to 6.96% in July. However, this was a short respite as the rate bounced back in August and touched 8.3%. As per data by the Centre for Monitoring Indian Economy, this was primarily driven by losses in farm jobs due to the seasonal nature of employment and uncertainty caused this year by an erratic monsoon season. According to the latest CMIE figures, as of November, the unemployment rate in the country has declined from 7.75% in October to 7% in November, painting a hopeful picture for the upcoming year.

However, more importantly, the Labour Force Participation Rate (LFPR) of the country, which measures the proportion of a country’s working-age population that engages actively in the labour market, has fallen structurally during the course of the pandemic, painting a worrisome picture. The two COVID-19 waves have lowered the LFPR to around 40% as compared to 43% prior to the pandemic. According to a World Bank modelled ILO estimate for LFPR, India’s LFPR should be around 46%, with global LPR being around 58.6%. A falling LFPR indicates that there are fewer people in the job market, and for India, most of them happen to be women. According to World Bank estimates, India has one of the lowest female labour force participation rates in the world. Overall data from CMIE showcases that compared to the pre-pandemic level, the likelihood of women being employed is 9.5 percentage points lower than that of men, indicating a widening gender gap in employment.

Shreya Maskara/New Delhi

Contributing reports by Damini Mehta, Junior Research Associate at Polstrat and Ananya Sood, Devak Singh, Sashwat Pandey, Interns at Polstrat.

From Polstrat, a non-partisan political consultancy which aims to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.

Read more about Polstrat here. Follow us on Medium to keep up to date with Indian politics.

Polstrat is a political consultancy aiming to shift the narrative of political discourse in the country from a problem-centric to a solutions-oriented approach.